With the introduction of Ethereum, smart contract platforms became a necessity in the crypto market. Today, they are the underpinning technology for some of crypto’s most interesting applications – including non-fungible tokens (NFTs) and decentralized finance (DeFi) applications. Below, we’ll look into 5 of the most popular smart contract platforms, as well as the coins associated with them:

1. Ethereum (ETH)

Ethereum takes the top spot on our list. It is the most popular smart contract platforms, and it remains the most broadly used blockchain in general.

As for Ether, it has comfortably coasted off its position of being the second most valuable cryptocurrency. The market rally has been strong in 2021, pushing Ether to an all-time high position of $4,372. Following successive downturns, Ether looks to be rebounding.

Today, ETH is trading for $3,175 – down 5 percent on the day, but still up 4.8 percent in the past week. The market entered into a bit of a correction period, so, understandably, ETH is trading down. But, corrections are expected, and ETH is in a strong position.

For technicals, ETH is trading above its 2-day moving average (MA) of $3,171 and its 200-day MA of $2,350. The asset’s relative strength index (RSI) stands at 57.55, showing that investors have sold off quite a lot over the past 24 hours. Regardless, ETH’s rally should continue soon.

2. Cardano (ADA)

Cardano is a high-performance blockchain that has gotten a great deal of attention in recent times. It isn’t yet a part of the smart contract platforms club, but the blockchain’s developers have confirmed that they will bring smart contract capabilities to it soon.

According to reports, Cardano’s smart contracts are coming in early September. The market has definitely noticed, with Cardano’s ADA token reaching new highs this month. ADA has now leapfrogged Binance’s BNB token to become the third most valuable cryptocurrency. Lark Davis, a popular crypto trader, and influencer describes the upgrade as a possible catalyst for a 6x bullish run.

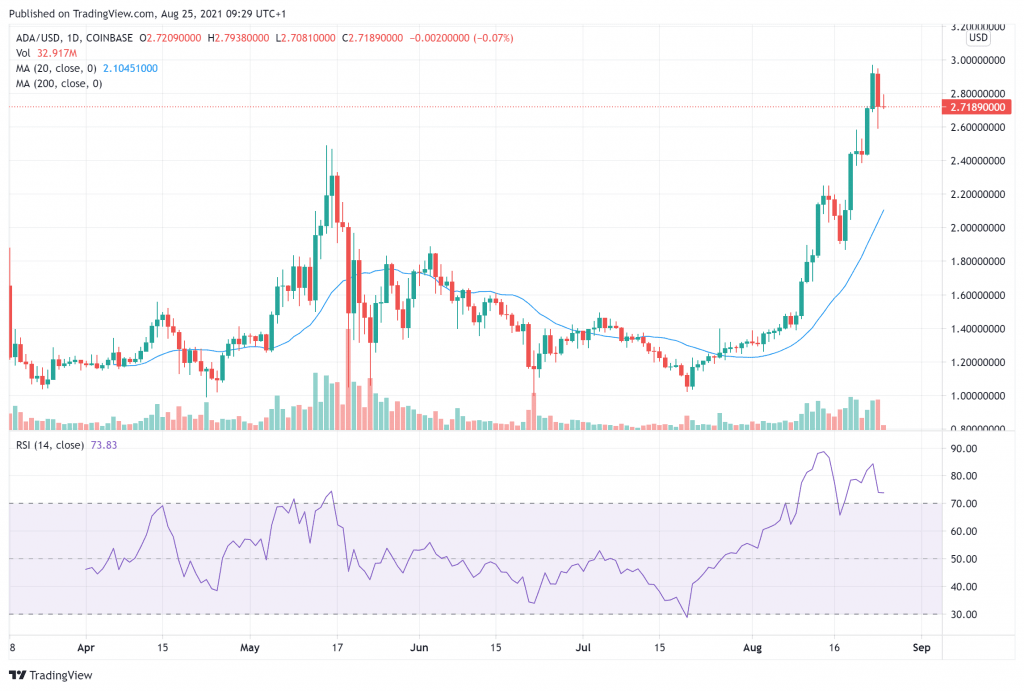

Trading at $2.72, ADA is down 6.7 percent in the last 254 hours but up a staggering 39 percent in the past week. The asset was able to cross its previous all-time high of $2.48 last week, and there remains enough to push beyond the $3 mark.

ADA’s technicals are strong, with the coin well above its 20-day MA of $2.09. As expected, the correction has caused a selloff as ADA’s RSI has dropped from 84.28 to 72.96 in the last two days.

3. Polkadot (DOT)

Polkadot is another smart contract platform that has gotten a great deal of attention in 2021. The self-styled “blockchain of blockchains” became popular following issues with developers on Ethereum.

Primarily, Polkadot’s objective is to improve scalability while also optimizing transaction speed and security. Using parachains, the network shares the “load” and makes it easier to run.

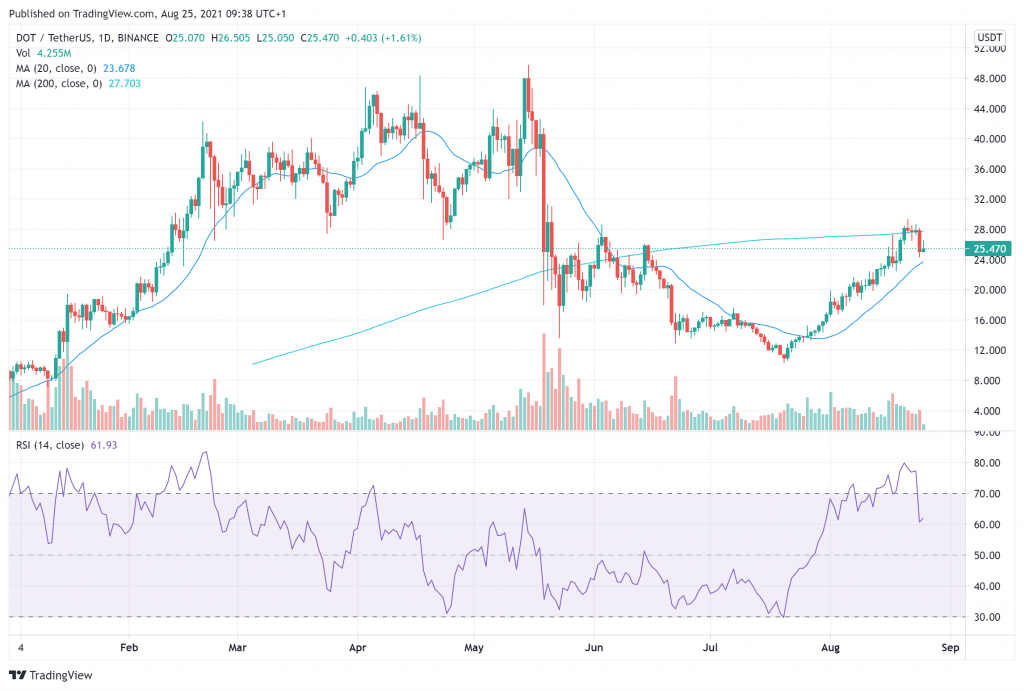

Polkadot’s DOT token occupies the #9 spot on CoinMarketCap’s ranking at the moment. The asset is currently trading at $25.47, down by 7.5 percent in the last 24 hours and up by 8.2 percent in the past week.

DOT seems to be in an interesting position. It is currently trailing its 200-day MA of $28.06, and its 20-day MA of $23.68 is quickly gaining on it. The asset’s RSI has also dropped and currently sits at 63.42.

There’s not much news about Polkadot, although its test chain – Kusama – is working on launching parachain auctions to developers. Both blockchains move together, and so do the coins. The Kusama project has so far been quite successful, so investors have something to be excited about.

4. TRON (TRX)

TRON is an interesting smart contract blockchain that looks to decentralize the internet. One of the largest blockchains, TRON looks to make sharing content on the internet easier and fairer. The TRON Foundation – its developers – have also been involved in several other pro-crypto projects.

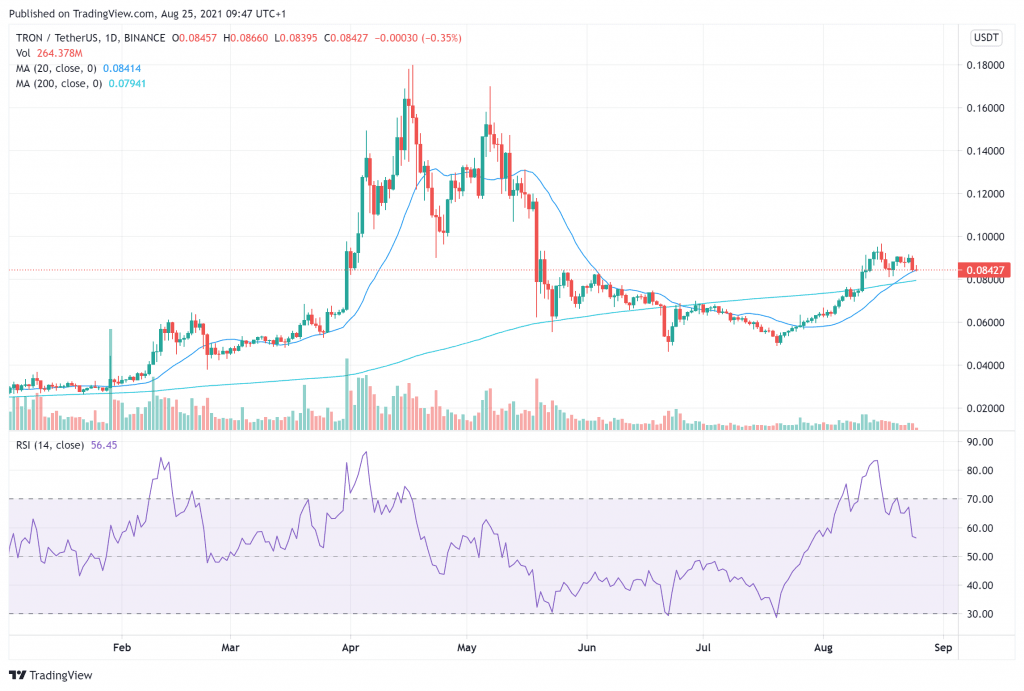

TRON’s native token, TRX – has dropped significantly on the coin rankings. But, it is still highly popular. The asset currently trades at $0.0842 – down 7.3 percent in the past 24 hours and 0.9 in the past week.

Like DOT, TRX is also in murky waters. The asset has seen a significant drop in RSI, with the metric’s current 56.04 point depicting a massive selloff. TRX has also dropped behind its 20-day MA of $0.085, and it isn’t so far from its 200-day MA of $0.078.

Despite this, the TRON Foundation has some interesting news. Earlier this month, the company partnered with WINKLink and APENFT to launch the TRON Arcade Fund – a $300 million fund that will allow the company to invest in GameFi projects over the next three years.

The company believes that GameFi will be the next big thing, merging NFTs with DeFi and the broader crypto space to improve adoption and understanding.

5. EOS (EOS)

EOS is a blockchain platform that allows users to host, build, and run decentralized applications (dApps). Launched by Block.one in 2018, the blockchain supports core functionality that lets users create blockchain-based apps. It offers secure access, permissions, authentication, data hosting, and seamless communication between these dApps and the internet.

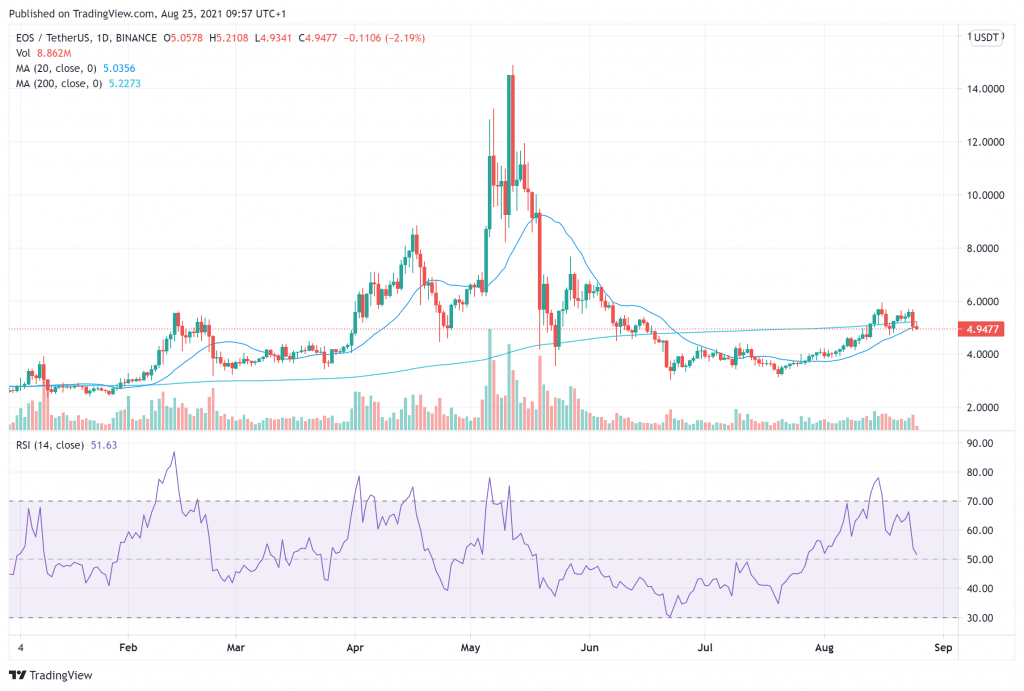

The EOS token is relatively a sleeper in the crypto world as it’s not so popular. But, its performance has been pretty impressive. The asset currently trades at $4.8, a far cry from its all-time high of $14.87. EOS is trading down 12.1 percent in the past day and 1.32 percent in the past week.

The asset’s technicals are mixed, trading below its 20-day MA of $5.11 and 200-day MA of $5.21. The RSI is also plunging, currently standing at51.73. As for news, EOS investors continue to wait for Bullish Global – an EOS-based crypto exchange being developed by Block.one.

The company announced the exchange back in June, following a massive $10 billion capital raise. Bullish Global is expected to go live later this year, combining features of centralized and decentralized exchanges. Block.one claimed that Bullish Global would operate independently, offering market-making features, lending markets, and portfolio management tools.

Credit: Source link