It’s a new week, and a new set of top coins to watch as the market begins another effort to climb out of bearish territories. Cryptocurrency prices didn’t particularly do well last week, but investors remain confident of a more positive outcome as this week goes by. So, what are the top coins to watch as September draws to a close? Let’s examine them below:

1. Bitcoin (BTC)

Bitcoin remains the most valuable cryptocurrency. Naturally, it would be included on our list of the top coins to watch. Throughout all of last week, crypto prices took big hits across the board. Bitcoin itself was significantly affected, with its price dropping by 4.18 percent through the week. Currently, Bitcoin trades at $43,736 – up 1.17 percent in the past 24 hours. A gain is always a good way to start the week, so investors are quite expectant of more gains. However, Bitcoin will need to pull in some strong performances to move out of its bearish trend.

Last Friday, the Peoples’ Bank of China (PBOC) announced a new set of rules aimed at outlawing cryptocurrency transactions in the country. The agency will be looking to coordinate action against the crypto space, working with other regulators and agencies to implement its policies.

Bitcoin is trading below its short-term moving average (MA) indicators, but its long-term MAs are still below it. So, long-term investors can still be confident about it. With a relative strength index (RSI) of 45.25, BTC is still very much underbought.

2. Cardano (ADA)

ADA has been in the news for the better part of three months now. The coin has been getting more attention following the launch of smart contracts on the Cardano blockchain.

We’re including ADA as part of the top coins to watch this week because of the continued work being done by the Cardano developers. Following the successful Alonzo hard fork and the introduction of smart contracts, Cardano has been making inroads into the decentralized finance (DeFi) and non-fungible token (NFT) space.

On Sunday, Cardano partnered with Chainlink – the top blockchain oracle – to serve DeFi platforms on its blockchain. The blockchain’s developers have also partnered with wireless service provider Dish to offer digital identity verifications services for the latter’s customers.

More announcements like these will only boost Cardano’s profile – and, by extension, ADA’s price. Day by day, Cardano continues to emerge as a top “Ethereum killer.”

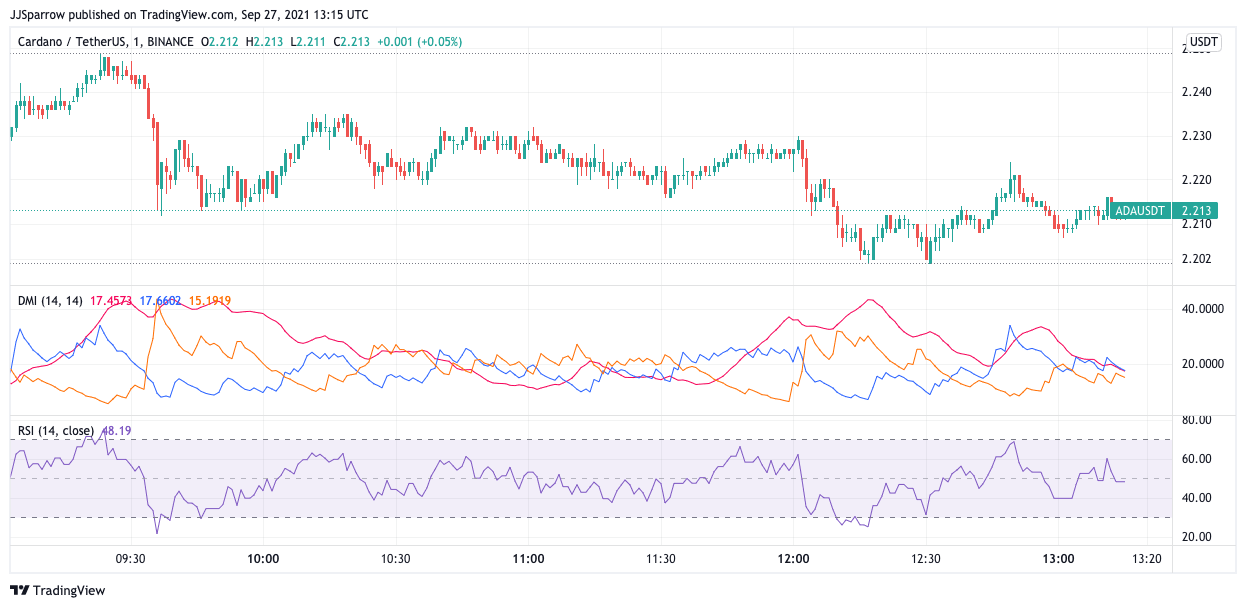

Like Bitcoin, ADA is showing mixed performances technically. The coin is trading below its short-term MA indicators, but its 100-day and 200-day MAs are well below it. ADA’s RSI of 45.16 also shows that the coin is much underbought.

3. Solana (SOL)

Solana has gotten a lot of press in 2021. The blockchain has seen significant growth in popularity, and this has only served to improve the profile of its native token, SOL.

Just last week, Orca – a decentralized exchange built on Solana – raised $18 million in its Series A funding round. The funds will go towards developing Orca’s automated market maker and integrating it into Solana. This joins several other updates that have come to the blockchain, showing further adoption.

As for SOL itself, institutional adoption and attention have been surging significantly. Last week, German stock market operator Deutsche Boerse announced the listing of three new crypto exchange-traded notes (ETN) from VanEck – one each for TRON (TRX), SOL, and Polkadot (DOT). The ETNs will be tradable on the Frankfurt Stock Exchange and Xetra – Deutsche Boerse’s digital stock exchange platform.

SOL currently trades at $147.08 – up 9.7 percent in the past 24 hours and 6.4 percent in the past week.

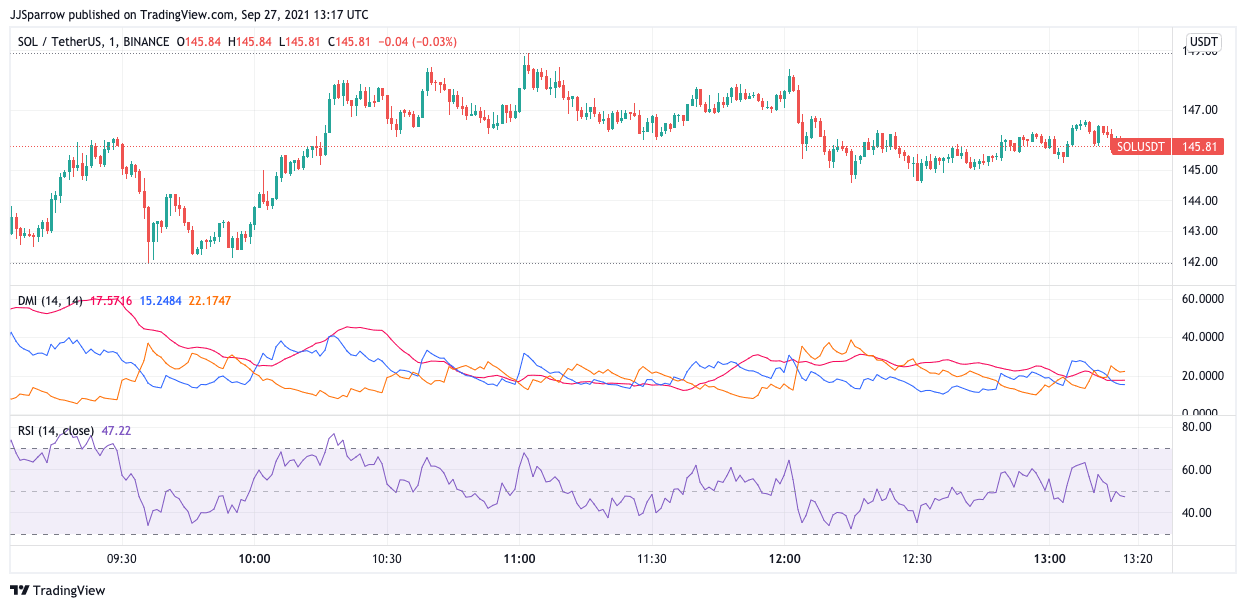

It will be interesting to see what new updates come to the Solana blockchain this week and what they could mean for SOL. For now, the coin is doing quite well, trading below all of its short-term MA indicators – save for its 10-day MA of $143.54. As expected, all long-term MA metrics are firmly below the SOL price. With an RSI of 53.31, this is definitely one of the top coins to watch for performance this week.

4. Tezos (XTZ)

Another high-profile blockchain token, XTZ makes it to our list of the top coins to watch this week. The asset itself has always been strong, even though it was never particularly one of the big dogs.

Last week, XTZ blacked against the broader market and rose by a healthy 4.76 percent. With most investors running for the hills and looking for safe havens, XTZ just might have been the perfect coin for them.

It will be interesting to see how XTZ performs this week. Will investors still buy into it as they believe its price will remain stable? Will they ditch it if the market starts to surge again? It could be a pretty big week for the coin, especially as it has been quite silent in the news cycle. There haven’t been many discussions about XTZ, meaning that it doesn’t have much in terms of fundamentals to hype. Still, the week could be a big one for the coin.

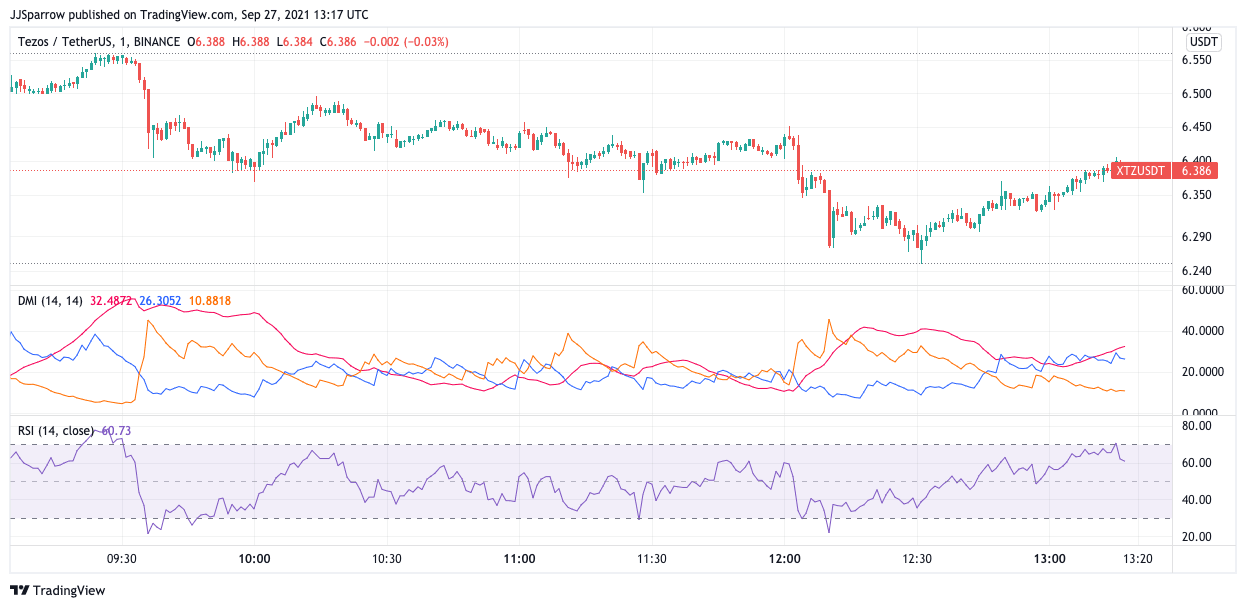

Thanks to its performance last week, XTZ is trading above all of its MA indicators – from the 10-day MA of $6.16 to the 200-day MA of $4.40. The coin’s RSI also stands at 54.20, showing that it is still underbought.

5. Celo (CELO)

Rounding out our list of the top coins to watch this week is CELO – the native token of the Celo Network, which aims to make crypto payments easier. CELO made big moves over the past month, rising by 89.6 percent. It will be interesting to see how the coin performs to round out the month and whether it can carry its momentum into October.

Currently, CELO trades at $6.26 – down 1.19 percent in the past day, but up 16.32 percent in the past week.

As for news, the Celo Network has joined hands with Mysten Labs – a blockchain development company that helped build Facebook’s Diem blockchain. The partnership will aim to boost transaction speeds and improve its smart contracts for developers.

Like many of its competitors, Celo appears to be taking the development approach towards mass adoption. Investors will be eager to see how this pans out, as well as if Celo has any more partnerships in the pipeline.

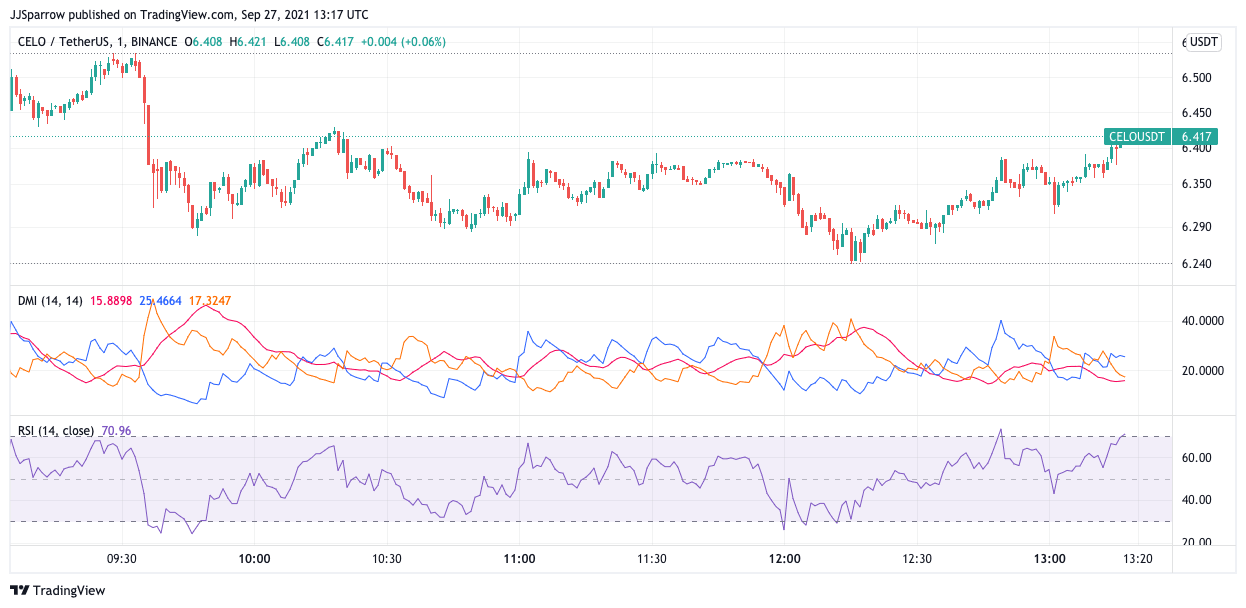

Currently, CELO is doing well technically. Its performance last week has been enough to take it above all MA indicators, from the 10-day MA of $6.21 to its 200-day MA of$5.75. An RSI of 57.09 shows that CELO is still very much underbought.

Credit: Source link