It was a bloodbath in the market on Monday. Those looking for the best cryptocurrency to buy will undoubtedly be feeling anxious as there’s no telling where the bottom is.

Still, experienced investors know that market crises are where there are the most opportunities.

Warren Buffett, perhaps the greatest value investor alive, once said, “Be fearful when others are greedy and greedy when others are fearful.”

The current market is incredibly fear-ridden, as shown by the Fear & Greed Index. But, you could take positions now and capitalize when the bulls return. We have some of the best cryptocurrencies to buy for interested investors.

1. Bitcoin (BTC)

Looking for the best cryptocurrency to buy that’s of value? Look no further than Bitcoin. Its status as the leading cryptocurrency – and one of the best investment assets – remains without question. It is leading the downturn, but Bitcoin never stays down for long.

The primary issue here is that the market has gotten a lot of negative news. China has been brutal to Bitcoin, with the country banning mining and the People’s Bank instructing commercial banks and payment service providers to close crypto accounts.

Several top banks – including AgBank, the Industrial and Commercial Bank of China, and the Construction Bank of China – have agreed and are now cracking down on these accounts.

Fearing government pushback, it is expected that companies like Alipay and WeChat pay will do the same.

Investors studying top cryptocurrency to buy would undoubtedly want assets that can preserve their holdings.

Basically, this means that there is little to no time for chasing meme coins and assets with no value. If you’re looking for the best cryptocurrencies to buy, you will need to analyze the market and consider what each coin offers.

This is where fundamental and technical analyses come in.

With the market now turned bearish, Bitcoin remains the best hope for investors searching for the most valuable cryptocurrency to buy. The asset has shown its ability to bounce back from negative news and it always does.

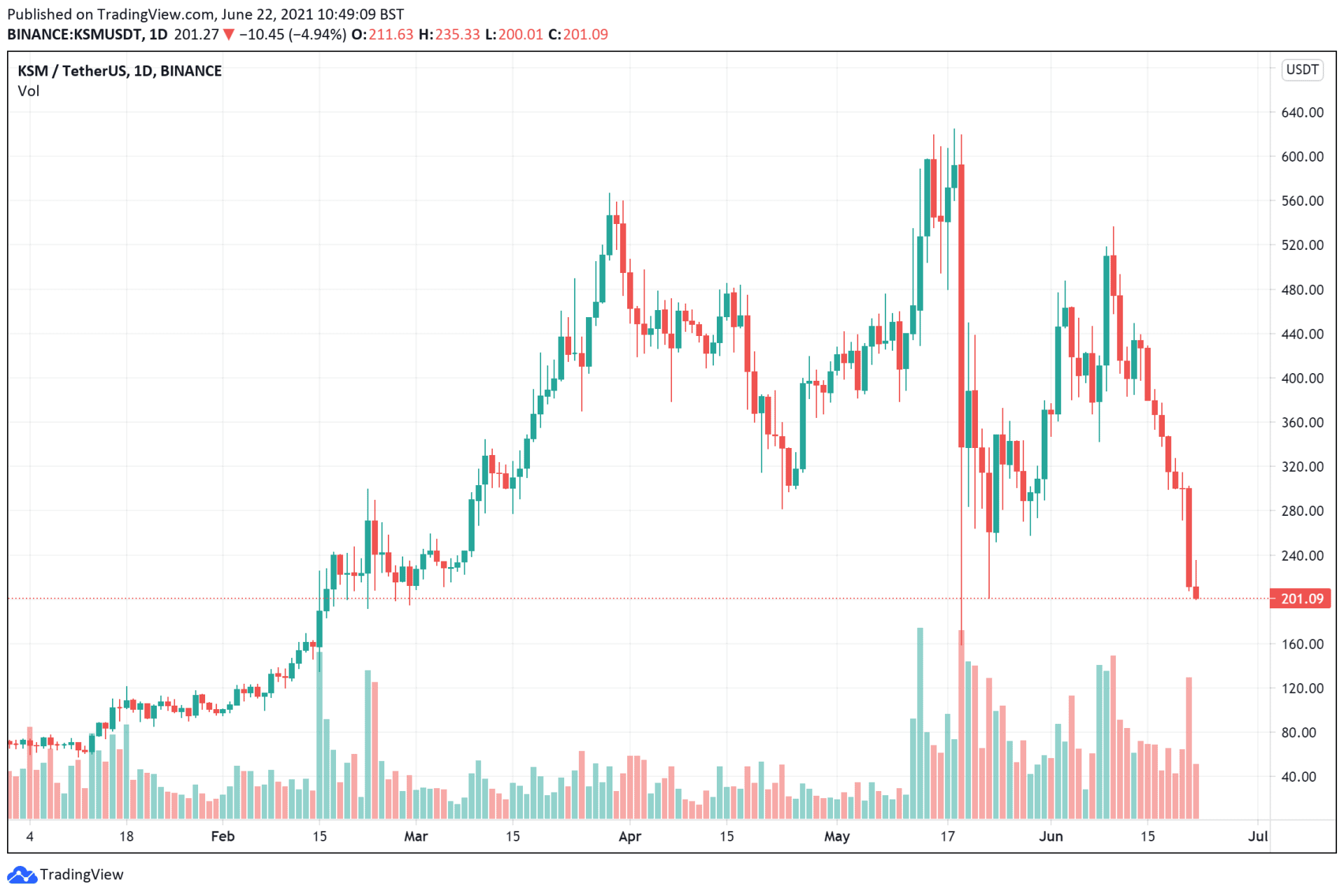

2. Kusama (KSM)

Kusama is one of the most popular blockchain platforms. The blockchain’s native token, KSM, could be a hot commodity soon.

KSM has fallen quite significantly over the past month. With a current price peg of $201.27, it is well over 50 percent off from its all-time high of $625.11. Still, there is a lot going for this asset.

We already established that the market will eventually rebound – bringing large-cap assets up again. However, the assets that will see the most gains are those with use cases that will prop their prices up even more. This is what makes KSM such a hot commodity.

Last week, details on Polkaassembly confirmed that the first auction on the Kusama network will commence soon. It will determine the parachains that will be added to the Kusama relay chain, essentially joining Kusama’s sister blockchain – Polkadot.

The winner of the auction will be announced today, and the second auction will begin immediately after it.

News like this shows that the Kusama network is gearing up for its full launch. Once projects can launch on it, the use of KSM will surge – bolstering the token’s value.

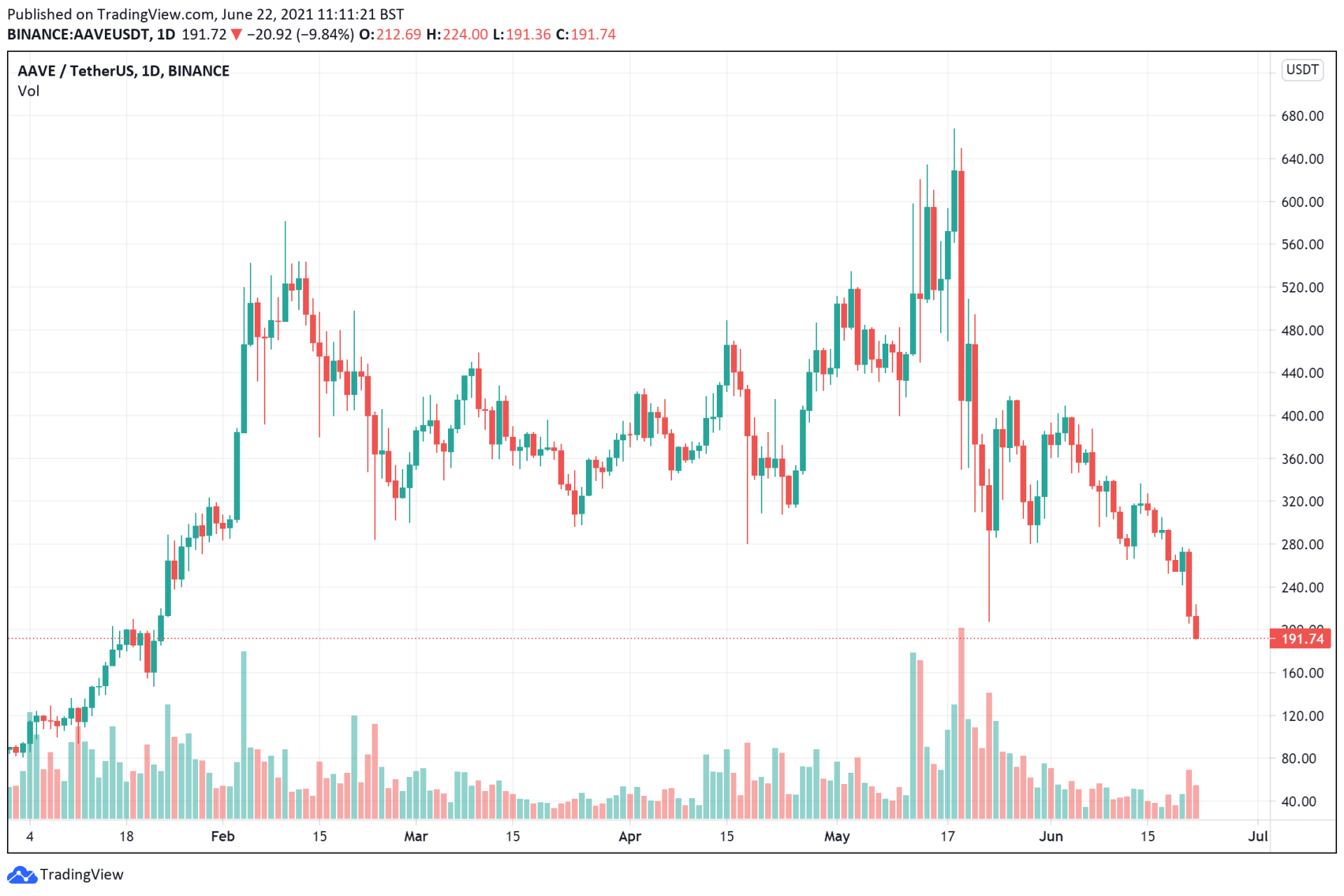

3. Aave (AAVE)

Anyone looking for a cryptocurrency to buy that is linked with DeFi will be better served purchasing the blue-chip assets. With that in mind, it doesn’t get any “deFi blue-chip” than AAVE – the in-house token for lending protocol Aave.

Aave is currently the top DeFi protocol, with $10.04 billion in total volume locked – 20.4 percent of all assets locked in DeFi, per data from DeFi Pulse. It has fallen 71 percent from its high of $665.91, and it currently trades at $191.74.

Like Bitcoin, AAVE will benefit from being the leader in DeFi. This means that it is in a good place to benefit when the rebound happens and coins get back to profitability. It also benefits from being linked to a platform with a solid use case – Aave has been a DeFi leader since the very beginning.

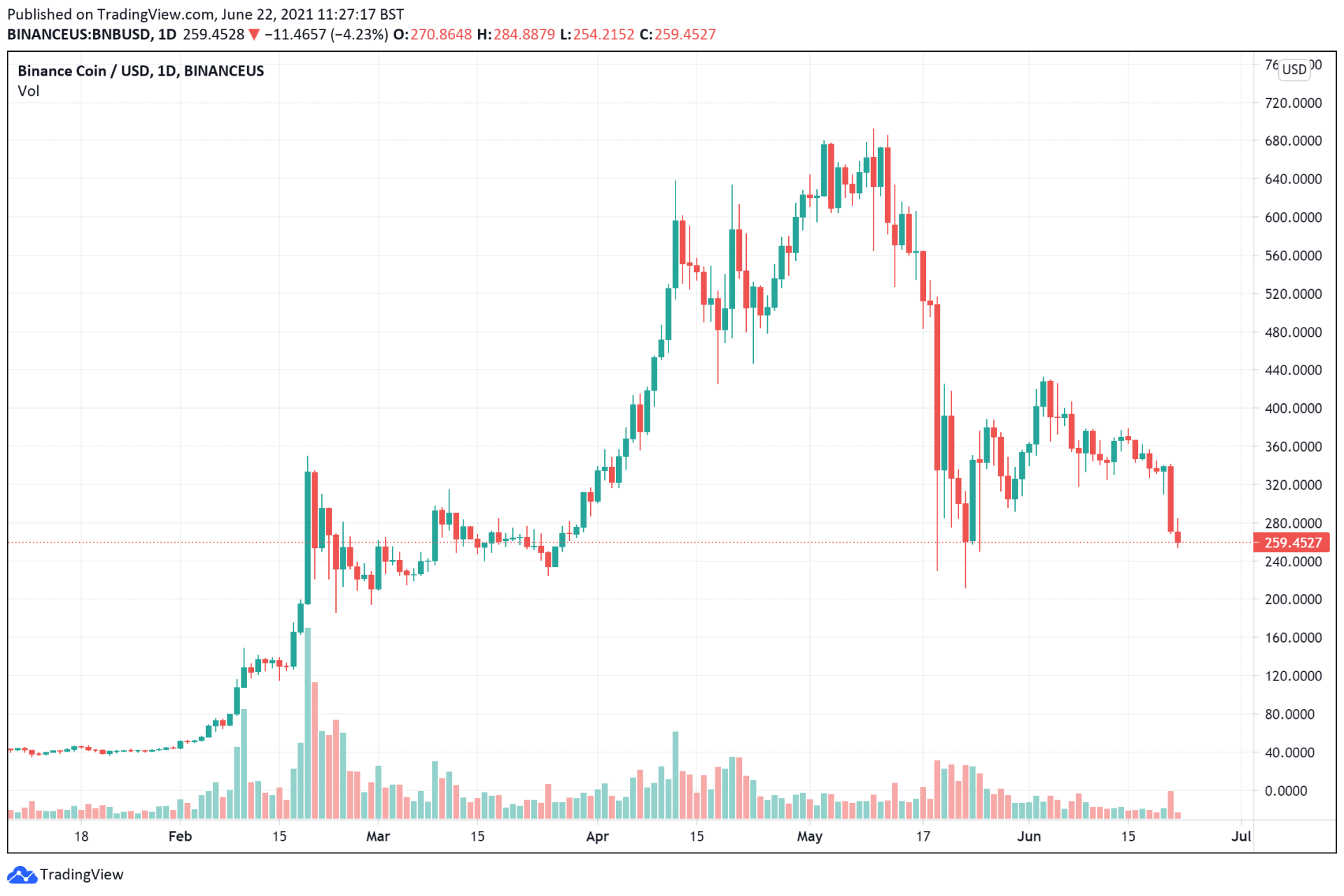

4. Binance Coin (BNB)

Binance Coin (BNB) is the in-house token for Binance – the world’s largest exchange. The token has been one of the most impressive crypto assets so far, enjoying primarily because of its links to Binance.

However, BNB has also gained from increased use of the Binance Smart Chain.

With app developers seeing continue challenges on the Ethereum blockchain, the Binance Smart Chain has been one of the latter’s top competitors. Increased adoption of the Smart Chain means that BNB will see a rise in its value.

This is in addition to BNB already becoming the world’s largest crypto asset by market capitalization.

The asset’s 2021 has been stellar, even though it has dropped by 62 percent from its all-time high of $691.3.

There are a couple of things to consider when hunting for the right cryptocurrency to buy.

You need to consider a coin’s future and what its developers are doing or plan to create with it. Also, large-cap assets tend to help investors since they have the highest values and will be the ones leading the charge as the market crawls back to recovery.

BNB’s technicals are pretty strong, especially with its relative strength index (RSI) at 31.6 – showing that it is severely underbought. It is a great asset to load up on as you prepare for bigger gains.

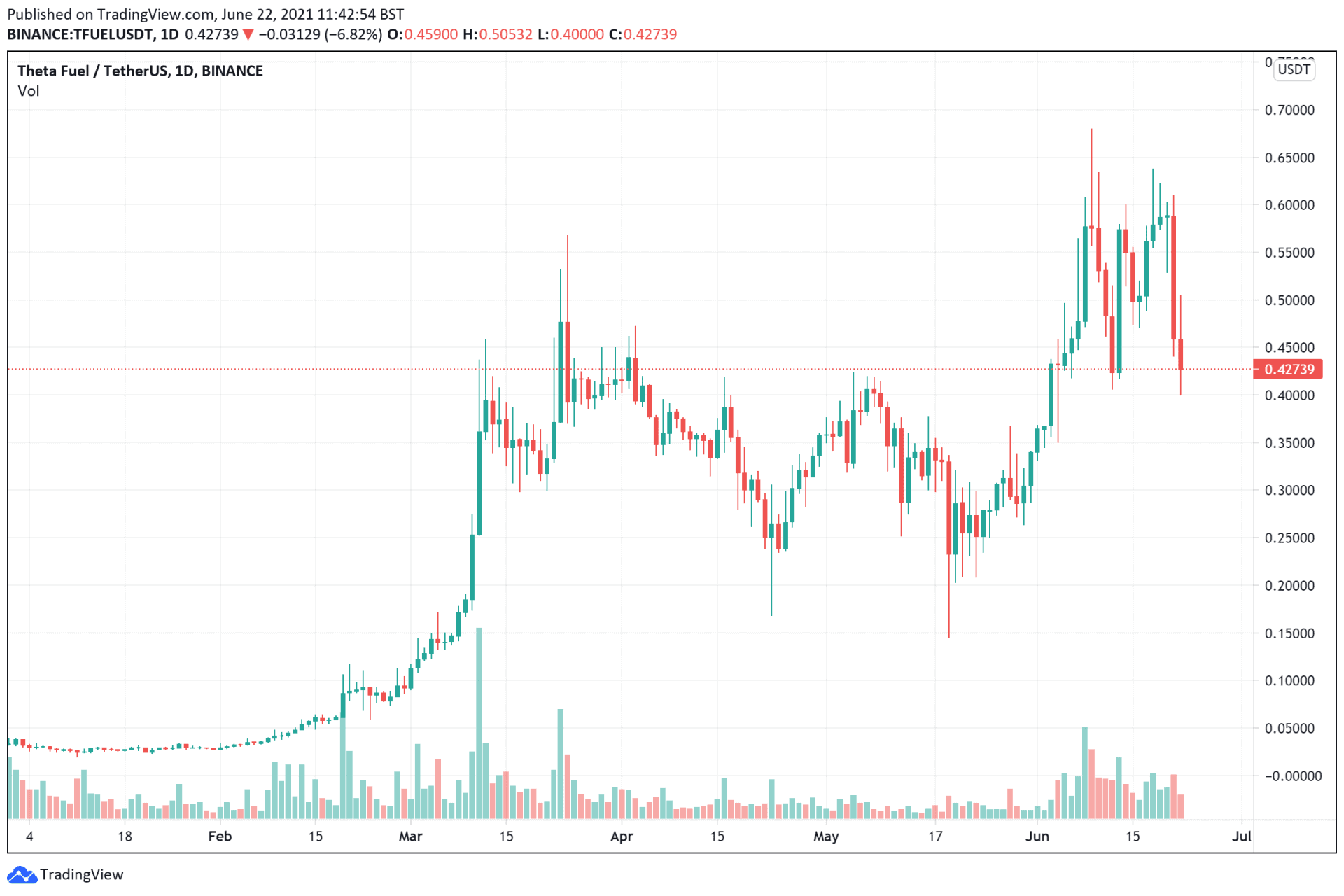

5. Theta Fuel

Theta Fuel is the token for the Theta Network – a blockchain-powered video delivery service. Theta allows users to watch content and share videos with other users. In turn, they earn tokens.

Like many tokens, TFUEL has been in freefall since May, when it hit $0.68. With a current price peg of $0.42, the asset is trading 38 percent off its all-time high – not bad, considering how far several others have dropped

TFUEL is a very promising project–past performance has proven that. There is also a lot of excitement as the Theta network is set for its Mainnet 3.0 launch on June 30. Like many platform tokens, increased adoption should see TFUEL surge.

Looking to buy or trade Crypto now? Invest at eToro!

Capital at risk

Credit: Source link