As the prices of some cryptocurrencies rebound, this is a great opportunity to buy at appealing entry prices. But note, you must consider your risk tolerance for digital assets investment before investing. Also, your familiarity with a cryptocurrency can help you select the coin wisely for investment.

You can buy cryptocurrencies either as an investment or for trading purposes, or both. For whichever option it may be, it will never be wrong to include digital assets in your portfolio.

5 Cryptocurrencies to Buy as Crypto Prices Rebound

1. Why buy Bitcoin

According to U.S.News, Bitcoin has more dominance in the crypto market after the first mining of the coin in January 2009.

Though the price of BTC cannot be predicted precisely, it has always been dynamic. When you think of the world of cryptocurrencies, the first thing that comes to your mind is Bitcoin. BTC is referred to as the kind in the cryptocurrency ecosystem.

In April 2021, Bitcoin tapped an all-time high of $65,000. This upward surge represents a doubling of its price from $30,000 in January 2021. The new price accounts for over 45% of the market capitalization of above $1 trillion.

A closer look in the crypto market shows Bitcoin is taking over 70% of the market earlier this year. This further implies that other cryptocurrencies are also rising. The dominance of Bitcoin in the crypto market can never be overemphasized. In May, Bitcoin’s market cap was above $1000 billion.

The rise in the value of Bitcoin also links to its use as collateral for loans, stablecoins, etc., in the DeFi sector. Bitcoin is also seen as a fence against instability in macroeconomics and inflation.

Although the Market Cap at press time is $721,243,653,029, and the price is at $38,559.92, there’s hope that it’ll rise again. From recent predictions concerning Bitcoin price, some crypto experts are forecasting a rise to $70k before the end of 2021. Investing in Bitcoin can later turn out to be a wise investment.

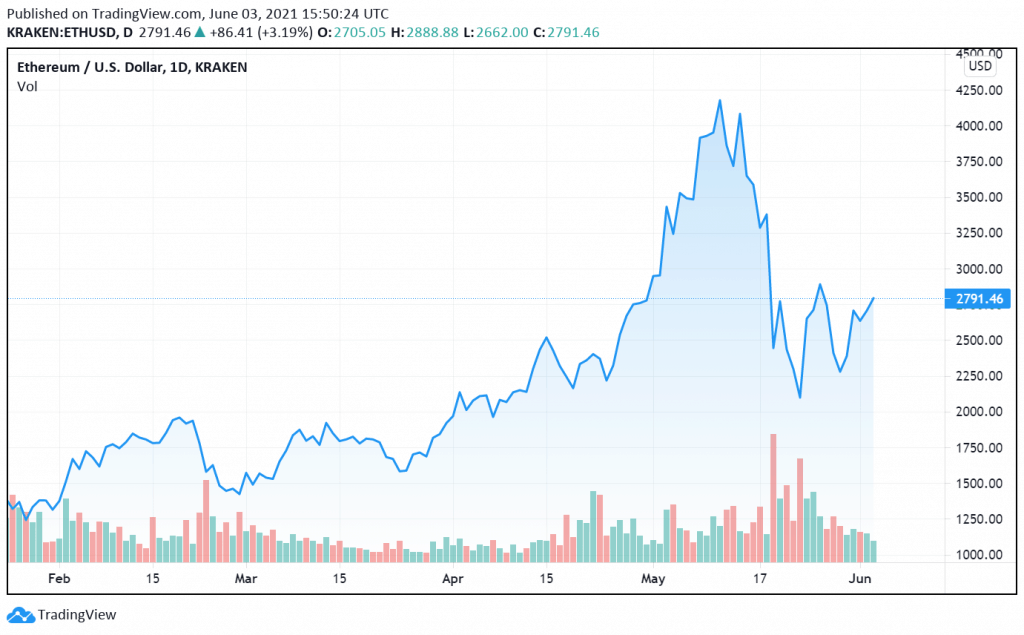

2. Ethereum a buy at $2,791

Ethereum is rated as the second-largest crypto after Bitcoin by market capitalization. Ether was created in 2015 and had a market cap of above $323 billion. The recent surge in its price suggests that ETH is getting ready for a bullish run.

Also, as the Ethereum blockchain upgrades, it boosts the value of the Ethereum-based tokens. With the launch of the Berlin hard fork in April 2021, the platform has some outstanding operational features.

It now improves network security, optimizes transaction fee usage, and permits a few types of new transactions. With the anticipation of another upgrade in summer 2021, London hard fork, you can anticipate ETH’s bright future.

Also, ETH turned down from its 20-day EMA at $2,762 on the 1st of June. This indicates that buyers were not in a rush to close their positions. Also, the flattening 20-day EMA and the rising RSA close towards the midpoint shows that the selling rush surrounding the crypto in recent times has died down.

So, if ETH buyers keep the price at a point above its resistance line, ETH/USDT pair may record a 61.8% Fibonacci retracement level at $3,362.72 and a 78% retracement level at $3,806.

In case if ETH bulls don’t sustain their price past the triangle, there will be a few days of consolidation in the triangle for the ETH/USDT pair. Any fall below the triangle will give the bears an upper hand.

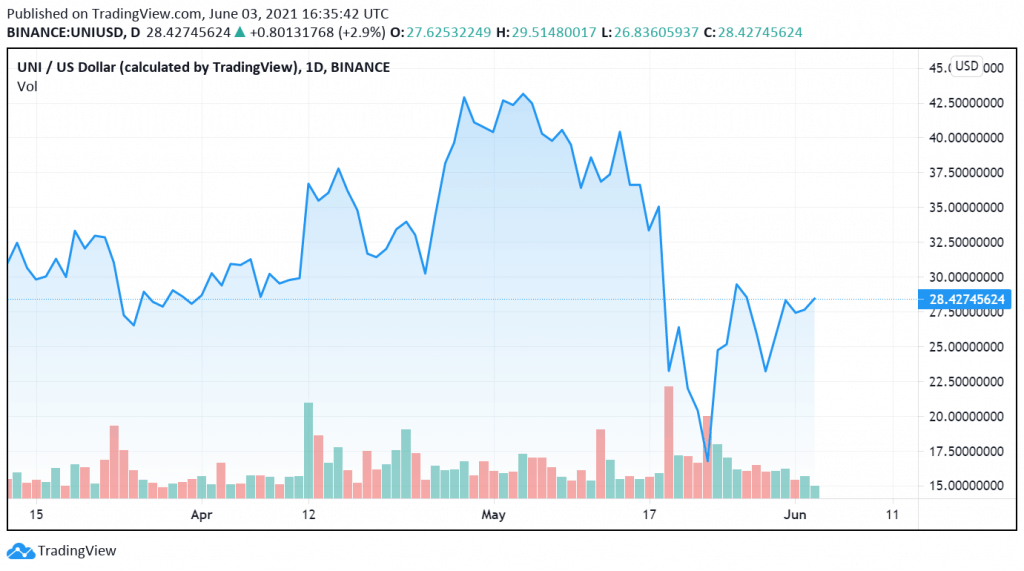

3. Buy Uniswap at $28.4

Uniswap operates on the Ethereum blockchain as the lead in the decentralized crypto exchange. It was created in 2018 as an open-source and is compatible with ERC-20 tokens.

Being a decentralized exchange (DEX), Uniswap gives the users control over their funds always. Thus, it removes the risk of asset losses in cases where the exchange is hacked.

Another distinguishing feature of Uniswap is its operation. It’s not controlled by any single entity. Also, users in Uniswap have the privilege of free token listing on the exchange.

Uniswap has over $3billion worth of digital assets on its protocol, which keeps it as the world’s fourth-largest DEX platform. Its token, UNI, is a governance token.

As a governance token, the holders of UNI can decide on the upgrades and developments on the Uniswap platform. The holders contribute to the distribution pattern of minted tokens to developers and the Uniswap community. They also influence changes in fee structures on the Uniswap platform. This raises the value of UNI and makes it very competitive in the crypto market.

Thus, UNI is a good digital asset for you to buy. Presently UNI’s price is at $27.99, and the total market cap is above $15 million. But according to experts, UNI might reach $119 in 2022.

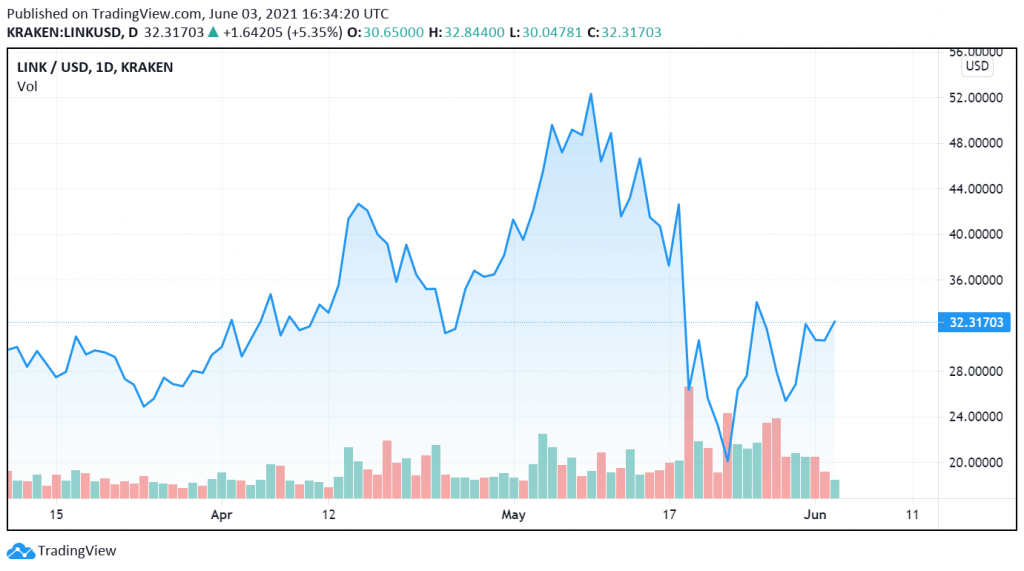

4. Buy Chainlink at $32

Chainlink is a decentralized network that operates through the use of oracles to pass information from the real world to the blockchain. The transfer of information is using enabled by smart contracts. Chainlink was created in 2017.

It is meant to bridge the gap in the blockchain industry by permitting interoperability. Thus, Ethereum, Bitcoin, and others are compatible. Chainlink provides the platform for banks and other payment services to be in the cryptosystem.

Chainlink is unique as it increases the accuracy and security of information. Its ability to bring this comes from decentralizing smart contracts in DEX.

A close study of the Chainlink token, LINK, shows it’s a viable investment for any investor. LINK’s price was $11.45 in January 2021. By May 2021, the price surged to $51.17. Presently the price is at $31.95, and the market cap is above $13 million. However, most crypto experts forecast a possible rise in the price to $100.

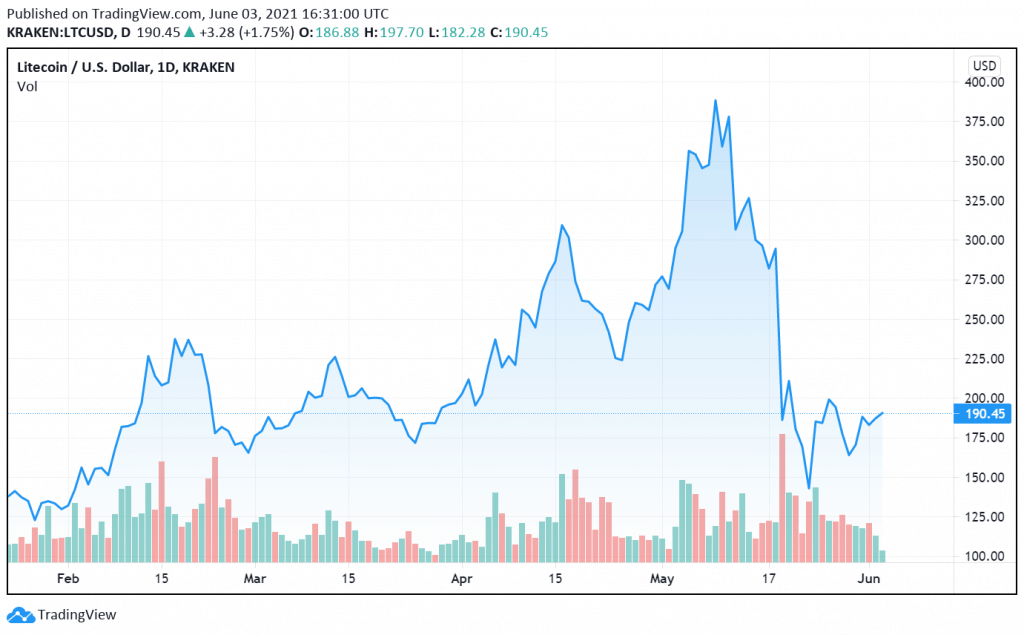

5. Litecoin a buy at $190

Litecoin as a cryptocurrency operates with peer-to-peer technology. It was created in 2011. The nature of Litecoin is complementary to Bitcoin. Just like Bitcoin, Litecoin runs its payment on an open-source system. This removes its control from any single entity or authority.

Litecoin has over 84 million LTC as its supply limit, while Bitcoin has just 21 million. The larger supply limit of Litecoin makes it the silver to Bitcoin gold.

Litecoin permits inexpensive and fast borderless transactions. Its referred to as the first successful altcoin (alternative cryptocurrency for Bitcoin). It’s quite stable and affordable for investors looking for searching for altcoins.

The Litecoin token, LTC, has made a tremendous rise in price from January 2021 to May 2021. The price rose from $126.23 to $477. This depicts an asset that will be very viable for investment.

Presently, Litecoin is trading at $189.95, and the market cap is above $12 million. From the forecast of crypto experts, the price of LTC is predicted at $1200 by the end of 2021.

Time to buy crypto – use dollar cost averaging

It’s never late to buy cryptocurrencies. But if tyou can’t decide when to dive in, then why not dollar cost average in by investing a manageable amount on a regular basis. Understanding the potential for each digital asset broadens your vision as you choose the ones to buy. Bitcoin is the king among the digitals assets. Its continuous surge in price makes it a very viable crypto to buy.

However, it’s the most expensive among all other crypto coins. So, if you’re not prepared for Bitcoin, you can switch to other altcoins that your risk tolerance can accommodate. This roundup of the 5 best cryptocurrencies to buy will help you select crypto coins that are more likely to surge in the future.

Credit: Source link