The cryptocurrency market has gained slightly today. Its total value has crept up to $2.19 trillion in the past 24 hours, having dropped to nearly $2 trillion yesterday. Altcoins are largely responsible for this increase, with bitcoin (BTC) actually declining a little. Chief among them was ethereum (ETH), which has jumped by 5% since yesterday. However, a number of newer altcoins have actually jumped by larger margins. Accordingly, we’ve picked our 5 best new cryptocurrency to buy now. This mostly covers coins which have been available for around a year or less.

5 Best New Cryptocurrency To Buy Now

1. Arweave (AR)

Arweave (AR) is the best-performing cryptocurrency of the past 30 days. It hit an all-time high of $68.96 less than one day ago. While it has since dropped down to $60.50, this is still a 2% rise over the past 24 hours and a whopping 116% rise in the past week. On top of this, AR has appreciated by 424% in the last month.

Arweave is a decentralised information storage network. Launched back in 2018, it has come to prominence more recently with the concurrent rise of Solana. That’s because its network underpins many of the NFTs and NFT platforms operating on Solana. As a result, an increase in Solana’s traffic has resulted in Arweave’s traffic also increasing.

Wild. @solana NFT apes in full force! 4x traffic increase to https://t.co/3S12ndZ16m in 12 hours.https://t.co/cXAcsN7S3I is scaling up as we speak, but remember: integrate dCDNs like @NetworkMeson and @Media_FDN to gain properly decentralised and fast access to permaweb data! pic.twitter.com/IMIpQQjQiW

— Sam Williams (@samecwilliams) August 30, 2021

2. Avalance (AVAX)

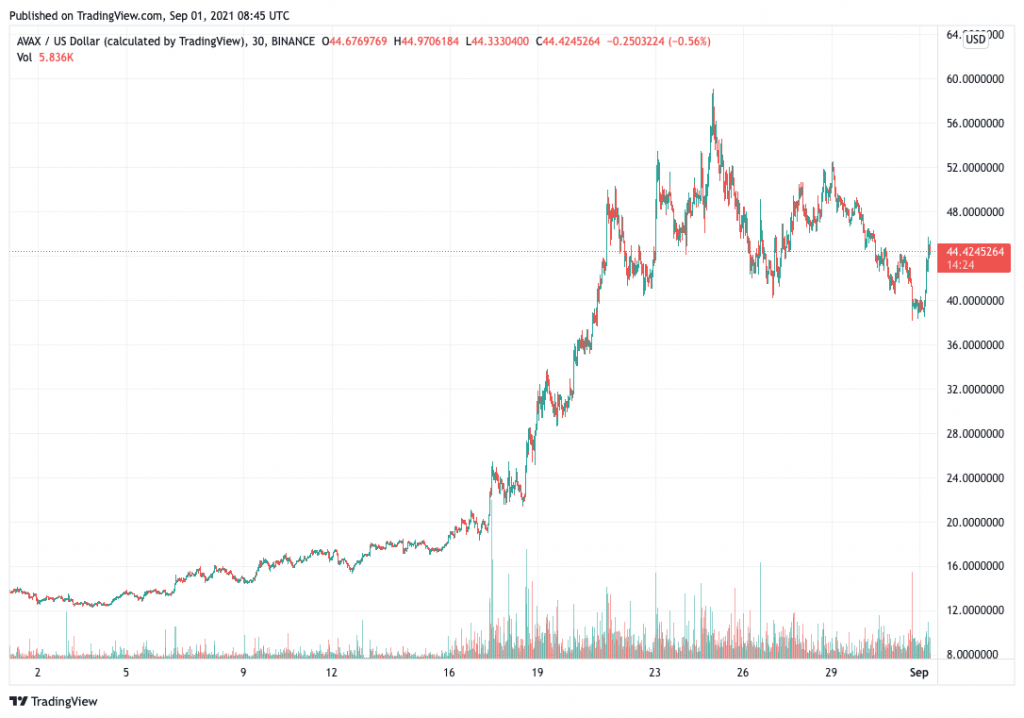

Avalanche (AVAX) has just begun a rebound, having fallen over the previous couple of days. At $44.86, it’s up by 2% in the past 24 hours. This will go some way towards helping it recover from its 19.5% drop over the last week. Despite this fall, however, it has increased in price by 90% over the past fortnight, and by 250% over the past 30 days. These increases are enough to make AVAX the second best-performing coin over the last month, behind AR.

Fans of AVAX may be disappointed that it had recently climbed down from its previous surge. Nonetheless, it’s likely to resume rising once again, not least because it has already begun a recovery today.

Aside from being a high-speed blockchain in the mould of Ethereum, Solana, and others, Avalanche is notable for burning its transaction fees. Combined with its fixed maximum supply of 720 million AVAX, this burning policy will make it deflationary over time.

This has helped to invite interest in AVAX in recent weeks. Another key factor is August’s launch of Avalanche Bridge. This is a protocol that facilitates asset transfers between Avalanche and Ethereum, making it cheaper and easier than its predecessor, Avalanche Ethereum Bridge. Having launched at the beginning of last month, it has now already expanded to handle a total of $100 million in transfers. This offers some indication in why Avalanche and AVAX are becoming hot topics right now.

The Avalanche Bridge (AB) launched just 3 weeks ago.

Today, AB officially transferred over $100M in tokens to and from Ethereum.

Interested in using high-performance DeFi apps, with low transaction fees? Transfer your assets, and try #Avalanche DeFi! https://t.co/UAY69mSUgW pic.twitter.com/FrN69Ev7pA

— Avalanche 🔺 (@avalancheavax) August 19, 2021

Another key factor in the rise of AVAX is the launch of Avalanche Rush on August 18. This is a liquidity mining incentive programme, rewarding users with AVAX for providing liquidity. Ava Labs — the developers of Avalanche — are collaborating with Aave and Curve are collaborating on its. This, in addition to Avalanche Bridge, has resulted in an influx of new users to Avalanche. And generally, more users equals higher demand and higher prices.

Experience the power of #Avalanche. Welcome to #AvalancheRush, the $180M liquidity mining incentive program in collaboration with leading DeFi dapps–both on and off Avalanche– starting with @aaveaave and @curvefinance. And, this is just Phase 1! https://t.co/YGrrVB7Uqc

— Avalanche 🔺 (@avalancheavax) August 18, 2021

This is why, after becoming available around a year ago, AVAX is now one of the best new cryptocurrency to buy now.

3. Solana (SOL)

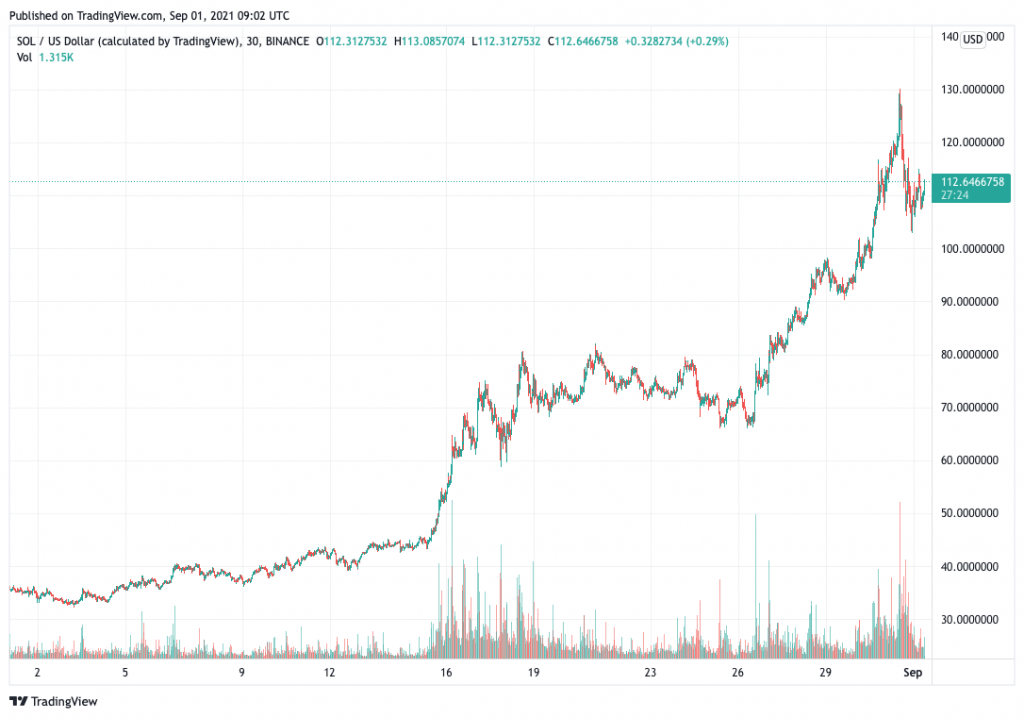

Solana (SOL) has had a record-breaking week. It set a new all-time high of $128.83 nearly 24 hours, although it has since retraced its steps down to $112.18. Even so, this is still 57% up over the last week, and 74% up across the past fortnight. Even more impressively, SOL has gained by 228% in the last month.

There are a couple of main reasons for SOL’s substantial growth in the past few days and weeks. For one, the launch of the Wormhole protocol on August 9 has helped it massively. This is another cross-chain transfer protocol, which permits users to send tokens between Solana, Ethereum, Binance Smart Chain and Terra. All four blockchains have benefitted from this, but Solana — and SOL — have benefitted the most.

1/Today we’re incredibly excited to announce Wormhole: a generic cross-chain messaging protocol. Wormhole will launch with support for the thriving @Ethereum, @Solana, @Terra_money, @binancechain ecosystems. https://t.co/pEKdeOW821

— Wormhole (@wormholecrypto) August 9, 2021

Because of Wormhole, Solana’s total value locked has risen to $3.38 billion, having stood at $1.3 billion at the start of August. A 160% rise.

More generally, Solana is attracting growing usage on its own account. Its Solanart NFT platform is enjoying a number of larger sales, with one collection from the Degenerate Ape Academy recently selling over 7,000 pieces of art to date and passing $14.5 million (in SOL) in volume.

Our top collection, @DegenApeAcademy, just broke 200000 $SOL in total volume! ($14,512,000)

With a total of 7439 sales, the average price is 27 SOL and current floor is 13 SOL!

Also, Solanart front page got updated today to give more exposure to the top #Solana NFT collections pic.twitter.com/CLC7tFqzmj

— Solanart – NFT Marketplace (@SolanartNFT) August 23, 2021

And while it launched its beta mainnet in March 2020, it hasn’t yet left beta. As such, SOL remains one of the best new cryptocurrency to buy.

4. Uniswap (UNI)

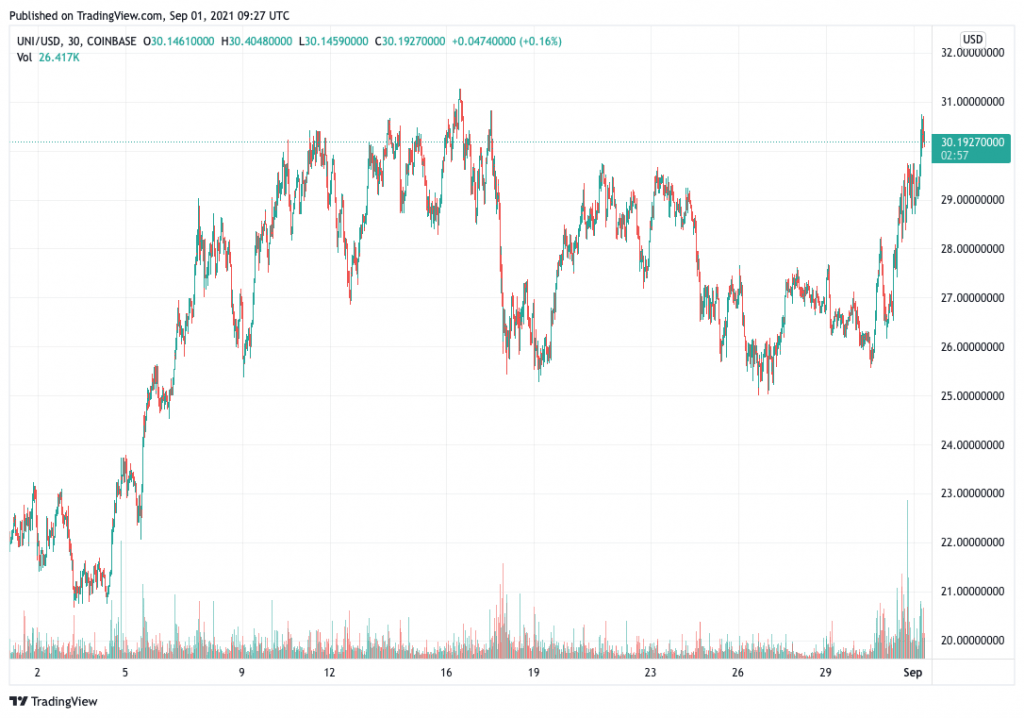

Uniswap (UNI) is another coin that has started to attract serious momentum only recently. Its current price is $30.33, representing a 9% jump in the last 24 hours. It’s also up by 13% in the last week and by 37% in the last month.

Uniswap is currently ranked sixth for total value locked among DeFi platforms, according to DeFi Pulse. It has just over $7 billion TVL, a figure which rose from $5 billion barely a month and a half ago. This follows on from the launch of Uniswap V3 in early May, which provides 4,000 times greater capital efficiency than V2. It also follows on from the launch of liquidity mining, which rewards users for staking.

1/

🌊 We’re very excited to share that the Uniswap v3 liquidity mining contracts have been deployed to Ethereum mainnet and all testnets.

🧑💻 Developers can start using these contracts today! https://t.co/ygMkq3OiTU

— Uniswap Labs 🦄 (@Uniswap) July 1, 2021

While the controversial Infrastructure Bill hasn’t yet been passed in Congress, it’s possible that Uniswap will benefit from it. This bill will extend tax reporting and know-your-customer requirements to most entities involved in transferring crypto. That said, an amendment — which has been added to the bill in its current form — explicitly excludes decentralised exchanges such as Uniswap.

1/ We didn’t get the language we wanted in the final bill text. It’s better than where it started, but still not good enough to clearly exclude miners and similarly situated persons.

Here’s how it started and the final with the changes we were able to get. pic.twitter.com/Y0LSUf7UEY

— Jerry Brito (@jerrybrito) August 2, 2021

If the amendment remains once the bill is finally passed, Uniswap could see a big surge. More users would likely flock to the exchange in order to avoid tax reporting rules, which in turn would increase demand for UNI. This is why we’ve chosen it as one of our best new cryptocurrency to buy now.

5. Polygon (MATIC)

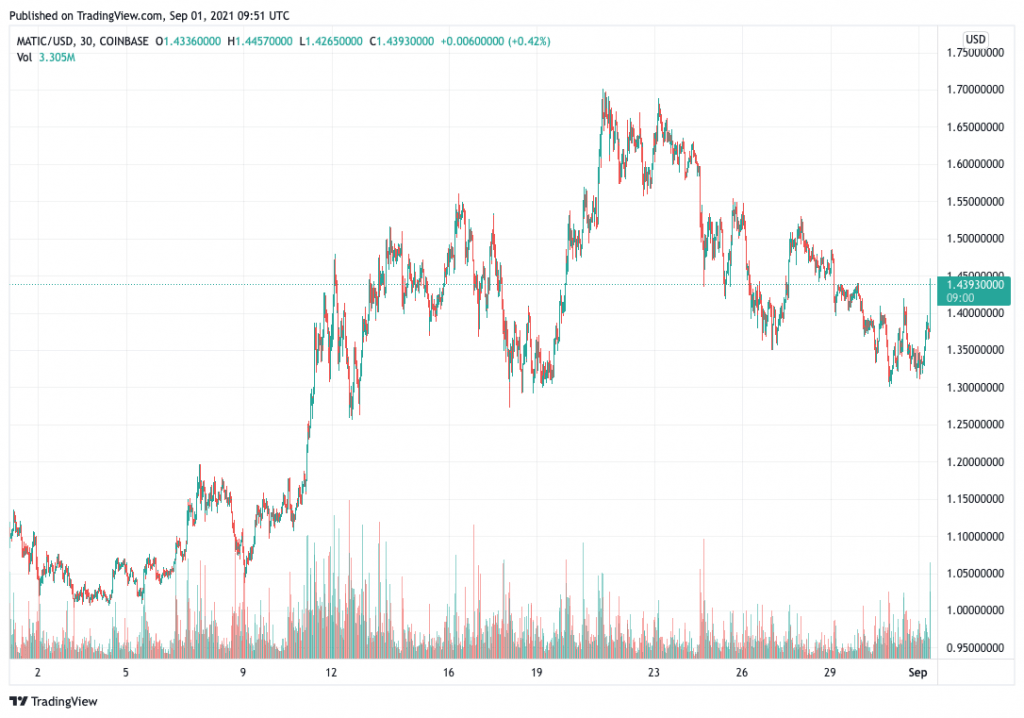

Polygon (MATIC) is rising significantly as we write this. At $1.44, it has risen by 4.7% in the last hour and by 6.6% in the past day, recovering from its recent selloff. Because it has fallen more or less consistently prior to this surge, it remains down by 3.4% in the last week. On the other hand, it’s up by 5.8% in the past fortnight and by 37% in the past month.

MATIC has been due to bounce back from its recent deep for a while. It’s a layer-two scaling solution for Ethereum, so given that ETH has been rising strongly in the past day or so, it too should rise in parallel.

Even without Ethereum’s good recent fortunes, Polygon has other good news to celebrate. Most notably, major exchange Coinbase announced yesterday that it will integrate Polygon as its first scaling solution for Ethereum. This is big news for the platform, and is the likely short-term cause for the current spike.

“We plan to integrate Polygon as our first scaling solution for Coinbase”

Polygon PoS mainnet support is coming to @coinbase https://t.co/1iXrWCpNKF pic.twitter.com/4TYxqemMbS

— sanket (@sourcex44) August 31, 2021

Aside from yesterday’s news, Polygon announced plans in mid-August to launch a DeFi-focused decentralised autonomous organisation (DAO). This has helped push it higher in recent weeks, adding momentum in conjunction with its acquisition of rival layer-two scaling solution Hermez. On August 13, it also announced a strategy aimed at developing zero-knowledge scaling solutions, which would be supported by $1 billion in funding.

1/14 It is a big day for @0xPolygon!

We are announcing a strategic focus on ZK-based scaling solutions and $1B in funding for this effort.

As our first big foray into the exciting world of ZK, we are excited to announce the merger/acquisition of @hermez_network! 🔥

Thread.. 🧵 pic.twitter.com/ayEjUEpSK6

— Polygon (@0xPolygon) August 13, 2021

At the moment, Polygon boasts some $10 billion in total value locked in. This figures stood at only $7 billion a month ago, and $2 billion in late April.

67% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link