June was a bit of a mixed bag for investors looking to buy DeFi coins. The entire crypto market struggled to shake off its bearish run, and there were periods in the month when things genuinely looked up. But, the bears are still prowling the market and there’s much work to be done.

Despite this, July is here and there are opportunities for investors to once more make money. The decentralized finance (DeFi) sector is especially vibrant, with the week starting on a relatively positive note.

Investors looking to buy the best DeFi coins will have to be careful to navigate the market. This article will help to provide insights and help you identify coins with significant potential. Below are some of the top DeFi coins to look out for:

1. DeFi Coins (DEFC)

If you’re a value investor who looks for the right opportunities to buy at cheap prices, DEFC might be the ideal choice for you. This coin has just been listed on its first centralised exchange, and it has a lot of potential for anyone who wants to buy DeFi coins.

DEFC rollout has begun. It is available on VinDAX from today (Wednesday 30 June). The asset is currently trading $0.28, after opening on VinDAX at $0.25.

Those who bought on the over-the-counter market as we previously advised are already in the money, with gains of more than 100%.

DEFC is the token for DeFi Coins – a marketplace that facilitates quick and seamless digital asset trading. The DeFi Coins community-driven platform promises to provide some of the most prominent benefits of DeFi, and DEFC will be a significant part of users’ ability to access that utility.

VinDAX will open trading for DeFi Coin @DeFiCoin5 DEFC/BTC, DEFC/ETH, DEFC/VD, DEFC/USDT trading pairs on 2021/06/30 08:00 AM UTC.

Full news at: https://t.co/9Bi3e6uZm5 pic.twitter.com/MHwUpUMERV

— VinDAX Exchange (@VinDAXOfficial) June 28, 2021

DEFC will allow holders to receive rewards. Trades also contribute liquidity to the DeFi Coins platform, improving users’ ability to trade and swap. This is an opportunity for you to get in on the ground floor of a promising platform.

DeFi Coin is also available via the homepage or by contacting support directly. Simply email [email protected] and the staff will help you through the buying process.

2. Yearn Finance (YFI)

Yearn Finance is one of the most popular DeFi platforms in the market. Here, you have a group of protocols built on the Ethereum blockchain that help users to optimize their earnings on digital asset trading and lending.

With Yearn Finance, you get several products in a single package. Users can launch these products based on their objectives and desires. YFI is Yearn Finance’s governance token, and holders get to earn rewards and also vote on platform developments.

YFI’s main value comes from its circulatory supply. There are only 30,000 YFI tokens available, and users can earn by locking cryptocurrencies in Yearn Finance contracts that run on Curve and Balancer platforms.

Since it was launched, YFI has seen an explosion in its value. As of January 2021, its value was competing with Bitcoin’s at $23,332. However, it soon overtook Bitcoin, reaching an all-time high of $94,873 by early May.

When the downturn hit, YFI’s value sank to $23,872. The asset has tried to consolidate since, but the bearish momentum remains strong. YFI currently trades at $32,176 – a 35 percent jump from its bottom.

For investors looking to buy DeFi coins with value, YFI has a lot of upsides. The asset’s 44.4 relative strength index (RSI) shows that it is underbought, and its 20-day moving average (MA) holds at $33,817. Breaking that line could set YFI up for some more gains.

3. Aave (AAVE)

Aave is currently the top DeFi protocol, with almost 20 percent of all assets locked in DeFi. The lending protocol allows users to provide liquidity and earn tokens in return.

AAVE is Aave’s platform token. As expected, users earn it in rewards and can use it for staking and governance. If you’re looking to buy DeFi coins with significant upside, AAVE is definitely a token you should consider. The DeFi market is currently trying to climb permanently out of a bearish hold, and the blue-chip tokens will be the ones to lead the recovery. So, buying AAVE seems to be a good decision.

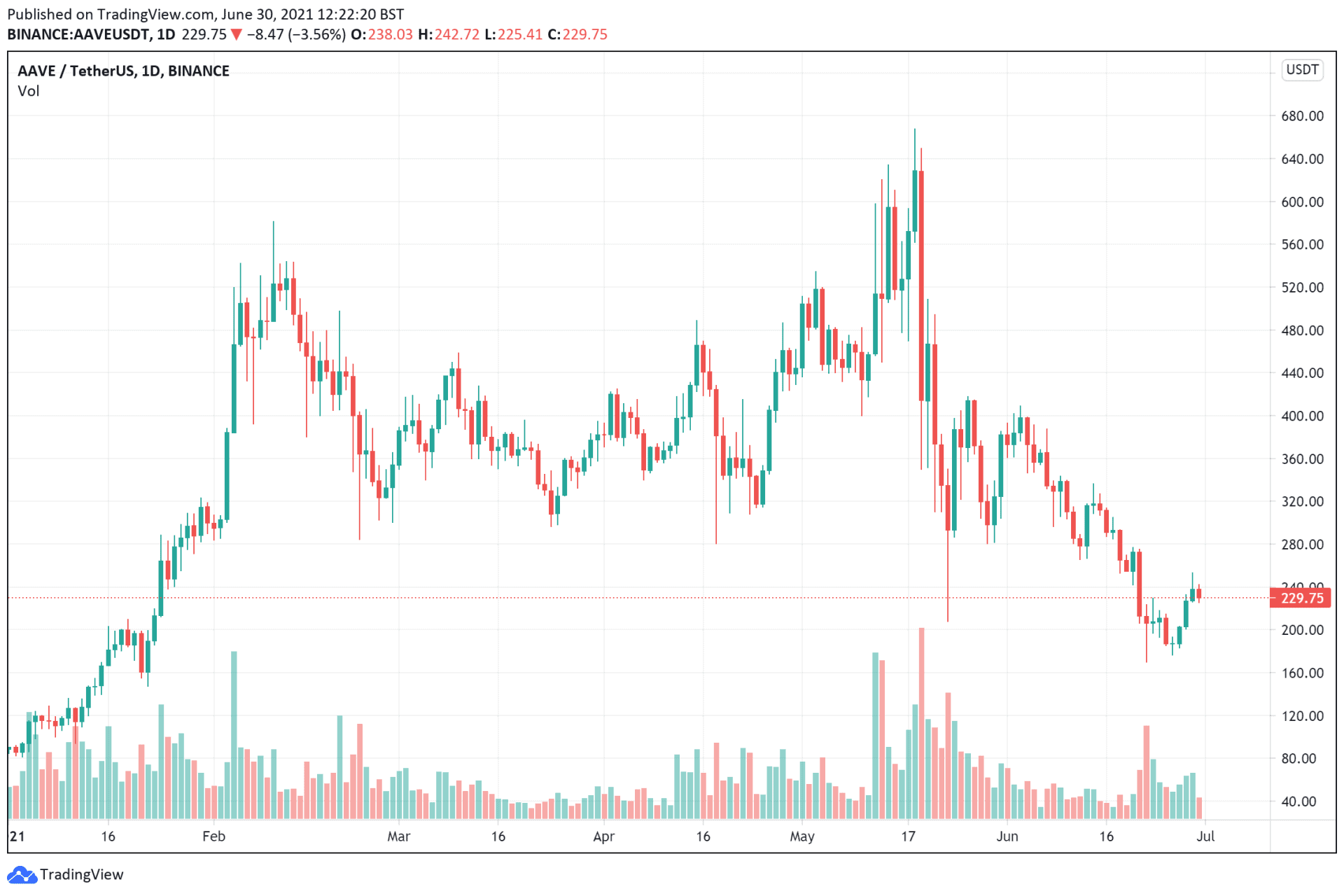

AAVE didn’t exactly perform well in June – despite Aave reclaiming the title of top DeFi platform. The asset’s price has been on a decline since crashing from an all-time high of $665.91, and it found a new low at $169.29 on June 22. But, with a current price peg of $229.75, AAVE has already beat its bottom by 35.7 percent.

Considering where AAVE is coming from, there’s a lot of upsides still for the asset. Aave itself is working on an expansion, with co-founder Stani Kulechov confirming that they will be releasing the platform’s v. 2.5 soon.

As part of the upgrade, Aave will launch a governance bridge that will let users vote on layer-1 for decisions that will affect layer-2 implementations. This will allow for cross-market decision-making.

4. Decentraland (MANA)

Decentraland isn’t exactly popular, especially since it is pretty new. Here, you have a virtual community built on the blockchain. Users can build and own plots of land, non-fungible tokens (NFTs), artwork, and more, selling them to others for profit. Members also participate in the Decentraland Decentralized Autonomous Organization (DAO).

Decentraland provides an online space, combining blockchain technology with virtual reality. Players have direct control over the online world’s rules, and MANA holders can vote on policies for the game – and Decentraland, the organization.

MANA launched in April, and its price jumped impressively from $1 to $1.6. But, May’s downturn nipped it, sending MANA to $0.48 on May 19. Following last week’s sharp downturn, MANA found new lows at $0.37. With a current price of $0.52. MANA is doing well to recover. The asset already 40.5 percent above its bottom, and things are looking up

Decentraland is already making big splashes, with a piece of land selling on the platform for $913,000 last month. Adoption plays like these will definitely help the platform’s cause.

5. Algorand (ALGO)

Algorand is another DeFi service that you might not really know about. It isn’t a traditional DeFi project, but it is an interesting platform nonetheless.

While DeFi provides protocols that help you earn money, Algorand is a high-performance blockchain that powers DeFi platforms. The open-source blockchain leverages a two-tiered structure and a unique variation of the Proof-of-Stake (PoS) consensus mechanism to optimize finality and transaction speed.

ALGO is Algorand’s native cryptocurrency, and it is currently the cornerstone of the blockchain’s network structure. As part of its design, rewards paid to validators for blocks are split amongst all ALGO holders.

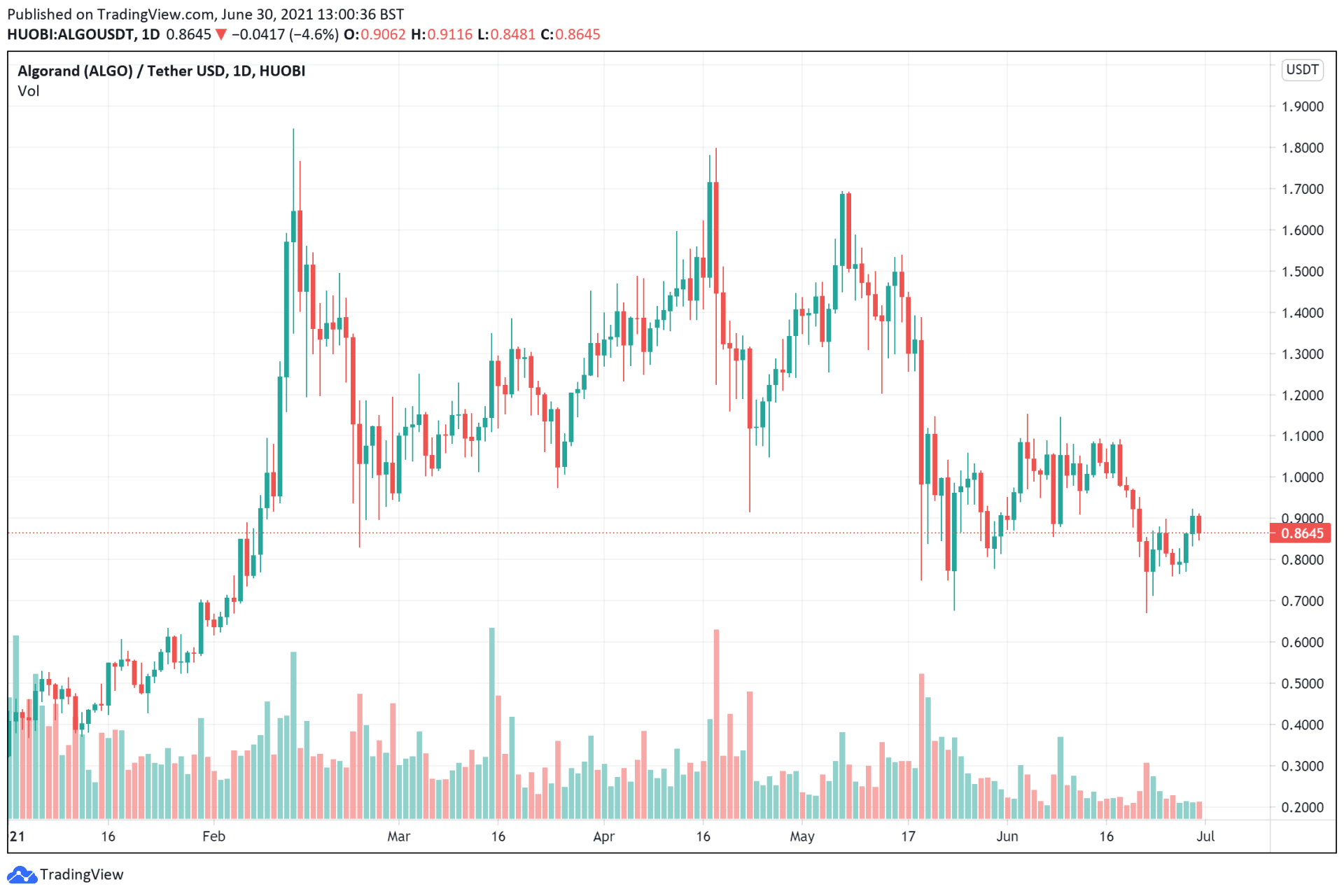

ALGO has performed quite well this year, moving from a starting price of $0.42 and rising as much as $1.82 in February. The asset climbed back to $1.79 following a brief consolidation, but May’s downturn eroded its gain and sank it as low as $0.6786 at the end of May.

In June, ALGO tried but failed to shake off its bearish rust. The asset found another low at $0.6701 last week, but it didn’t stay long there. With a current price peg of $0.8645, ALGO has gained 30 percent from its bottom.

Technicals for ALGO look good, with the asset’s RSI standing at 45.98 and its 20-day MA at $0.9183 – just above its current price. Algorand is set for big moves after securing $100 million in funding from Arrington Capital – a digital asset manager. The fund will support projects building on Alrogand, and it should encourage developers to come to the platform.

Capital at risk

Credit: Source link