The term “decentralized apps” (DApps) is now one of the most exciting in the blockchain sector. Decentralized applications and apps are the two terms that make up the moniker DApps. These are the software tools or programs that operate on the Ethereum Blockchain, a decentralized ledger. The two most important aspects of decentralized apps are scalability and openness.

In contrast to standard applications, these utilize the Ethereum Blockchain for their backend. The user will not be able to detect the difference between a standard app and this one since the front-end and back-end connections are identical. Since shutting down all of the distributed hosting nodes in a decentralized application is practically impossible, it is exceedingly tough to bring any program down.

Decentralized applications (dApps) are basically advanced apps that allow you to control all of your transactions, allow you to engage with a peer without being held responsible for it, and without someone always monitoring you. The functionality of these programs is not dependent on a user providing any personal data about themselves.

Having discussed the background, here is a list of the 5 best DApps to invest in for future returns:

1. Lucky Block

Binance Smart Chain serves as the foundation for the rapidly expanding lottery platform known as Lucky Block. When the platform’s creators saw a number of shortcomings in existing lottery systems, they decided to build Lucky Block. Lucky Block’s engineers are able to considerably boost the transparency of the lottery process by shifting it to the blockchain. One good feature of Lucky Block is that it is open to participants from across the globe.

Lucky Block has also made an interesting tweak to the frequency of reward distributions. While most big lottery organizations hold prize draws every week or bimonthly, Lucky Block holds daily prize drawings. For each contestant, this boosts their chances of winning and makes Lucky Block an attractive alternative to these older methods.

Invest in LuckyBlock Now

Your capital is at risk.

2. Defi Coin (DEFC)

DeFi Coin is another excellent crypto-decentralized program app in which you can invest your money. DeFi Coin is a community-driven initiative that aims to achieve 100% decentralization in the cryptocurrency market. After the launch, the development team disposed of all its tokens and joined the sale with the rest of the investors in the project’s success.

DEFC is the native digital token of the DeFi Swap platform. With DEFC, a DeFi swap may provide quick currency conversions, yield farming, stakes, and other internet-based services. As a result of DeFi coin’s use of Binance’s Smart Chain, transactions may be completed quickly and at a low cost. There are several applications for DEFC in the DeFi Coin ecosystem, making it a valuable utility coin.

Buy DeFi Coin Now

Your capital is at risk.

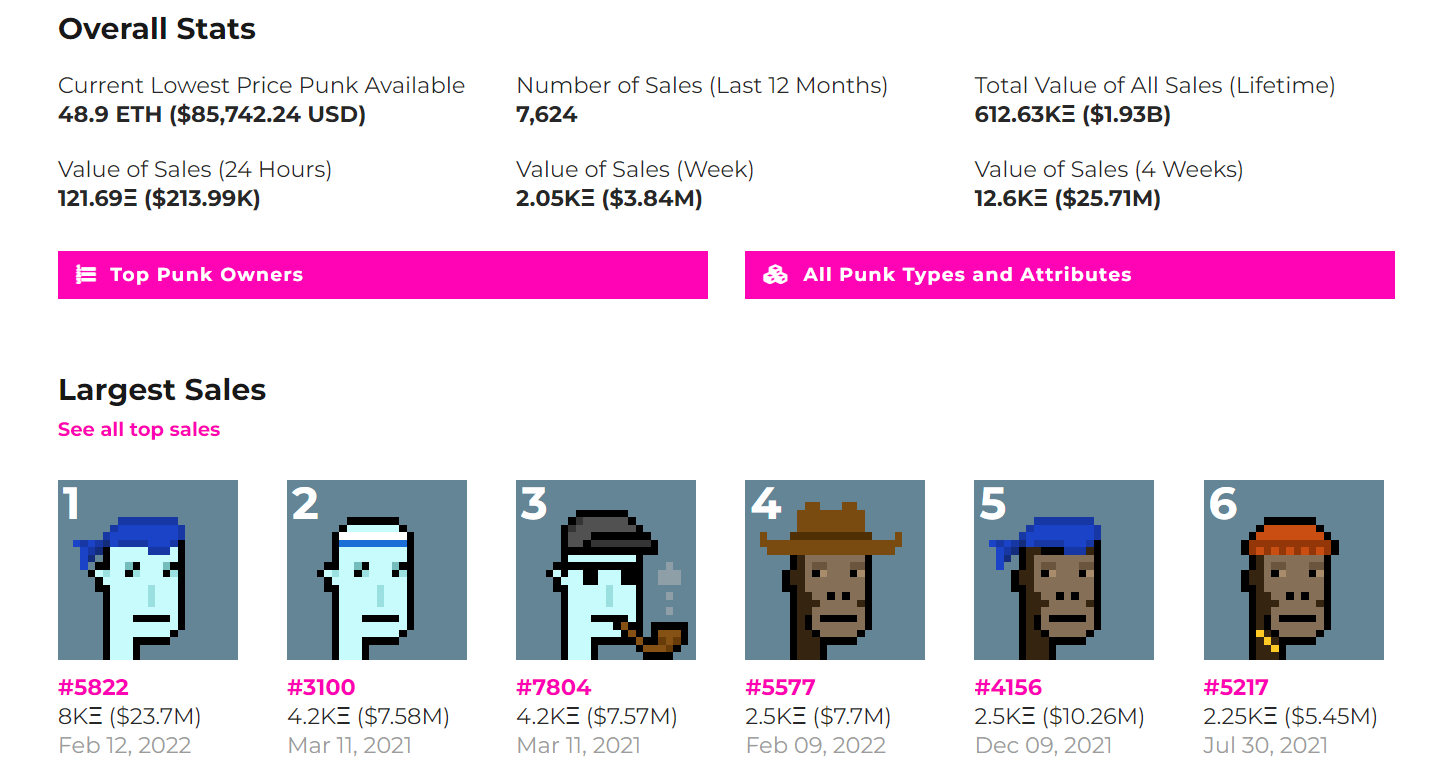

3. Cryptopunks

CryptoPunks are Ethereum NFT-based pieces of art that can be bought and sold. There are tens of thousands of these 8-bit punks, each with their own unique personality traits. Many crypto artists have been impacted by their early NFT projects, including the development of the ERC-721 standard for digital collectibles. There are a total of 87 different properties that may be shown by a single CryptoPunk.

Hats, pipes, necklaces, earrings, and eye patches are examples of “traits.” From a little online craze in 2017, CryptoPunks has blossomed into one of the world’s most widespread and well-known NFT ventures. Although it wasn’t exactly the first NFT project on Ethereum, it is definitely made its mark in the NFT market.

Every punk’s official website may be used to learn more about their own characteristics and current value. The fact that there are only 10,000 of these CryptoPunks sets them apart.

The creators won’t generate any more and won’t have any say in how widely they’re distributed. Anyone on the Ethereum network may possess a single punk. Every small, pixelated face in tiny squares has something special. Some of the smokers are puffing on pipes, others wear hats. Some of them may possibly be extraterrestrial in origin.

Buy Ethereum for CryptoPunks

Your capital is at risk.

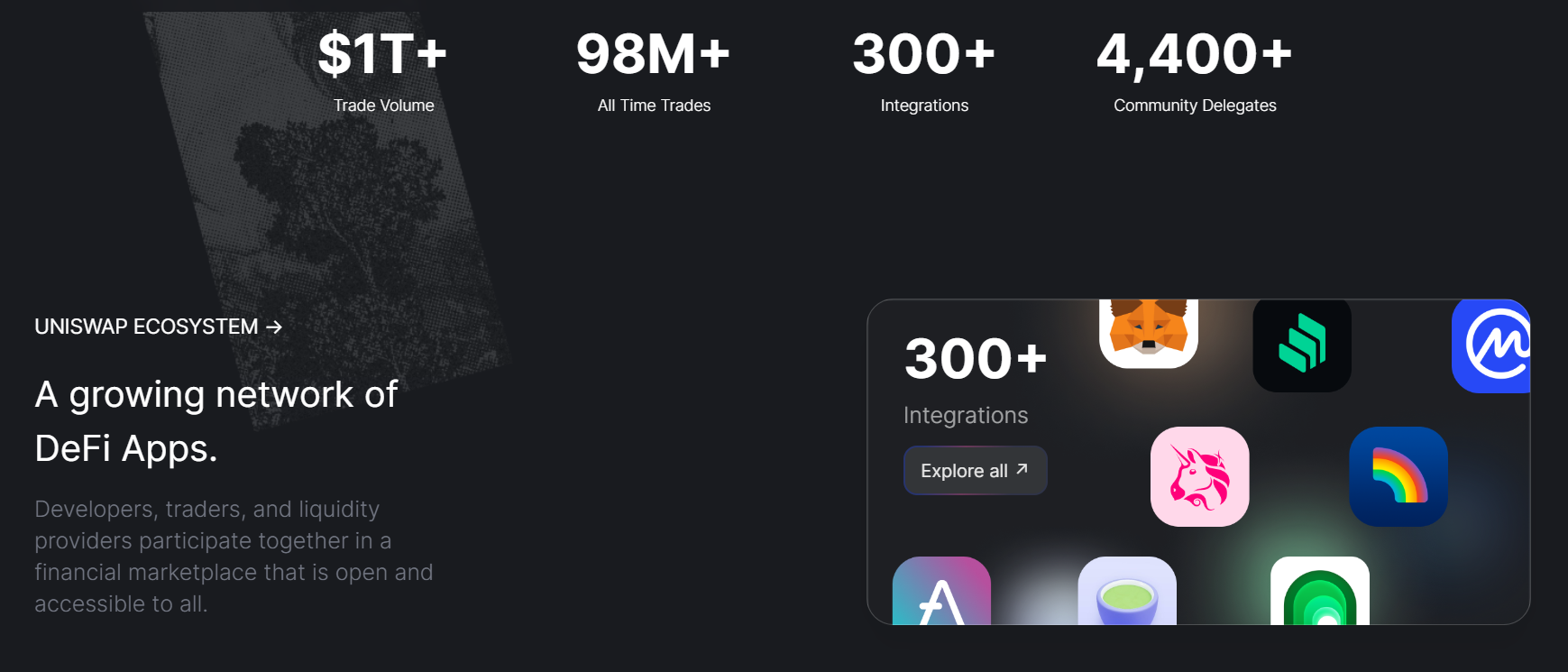

4. Uniswap

Uniswap is a series of Ethereum blockchain-based computer tools that enables decentralized token exchanges. An automated liquidity protocol (ALP) is a novel trading mechanism that is totally decentralized, meaning it is not owned or administered by a single company.

Anyone may use Uniswap’s code to build their own decentralised exchanges since it is totally open source. Users may even list their tokens for free on the market. Centralized exchanges like Coinbase and Bitfinex are profit-driven, and they impose hefty fees for the introduction of new currencies.

As it is more time-consuming and expensive to execute orders on a central database than on the blockchain, conventional exchanges compel traders to hand up their private keys. Decentralized exchanges (DEXs) allow users to retain ownership of their assets at all times. When a hack occurs, the risk of losing assets is eliminated. As of this writing, Uniswap is the fourth-largest decentralized finance (DeFi) network, with more than $3 billion in crypto assets kept on its system.

Buy Uniswap via eToro Now

Your capital is at risk.

5. Maker DAO

MakerDAO is an Ethereum-based decentralized organisation that enables peer-to-peer lending and borrowing of digital assets. In order to handle borrowing and lending, MakerDAO includes a smart contract service and two currencies: DAI and MKR.

On the Ethereum blockchain, MakerDAO is a company building technologies for borrowing, saving, and a stable coin. Anyone with an Ethereum address and a MetaMask wallet may borrow DAI, a stablecoin, using a new protocol developed by the company. Users may generate DAI by securing ETH in MakerDAO’s smart contracts.

The more ETH locked up, the more DAI generated. In order to unlock their ETH, which acts as collateral for their DAI loan, customers simply pay back the loan and any fees they may have accrued, as well. Because MakerDAO is a decentralized system, it is an excellent investment.

Anyone who holds an MKR token is instantly a member of the community and has the opportunity to vote on the project’s governance. This implies that if you buy MKR, you will be able to direct the course of MakerDAO in the future. One of the first protocols in decentralized finance, MakerDAO is an up-and-coming startup. Since its inception in 2012, MakerDAO has been the decentralized finance movement’s first and foremost leader.

Invest in Maker Token Now

Your capital is at risk.

Conclusion

There lies huge potential in both DeFi and dApps. As they are unknown to the masses, there lies a sort of first-mover advantage for investors in the present time. It makes sense to allocate a small portion of the portfolio to these initiatives. We suggest doing your own research and making the right investment choices as crypto assets are volatile and there are chances of losing whole capital too.

Read More:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards – Play to Earn Utility

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022

- Worldwide Decentralized Competitions

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Credit: Source link