The best cryptocurrency to buy for long term returns is a must-have for savvy investors. These assets have strong fundamentals and are bound to keep growing in the future. Let’s explore a few cryptos that fall within this category.

1. Ethereum (ETH)

Etherum’s growing importance in the booming decentralized finance (DeFi) subsector makes it one of the best cryptocurrency to buy for long term returns. Founded in July 2015 by Russian-Canadian developer Vitalik BUterin and seven others, Ethereum is currently a proof-of-work (PoW) consensus algorithm that has taken blockchain technology, regarding functionality, to the next level.

Ethereum native token Ether (short form ETH) serves as the fuel that powers the colossal Ethereum network. In addition, Ether is also used to buy and sell goods and services like Bitcoin. It is also used to settle network fees.

At press time, Ether is trading at $2,340.71, up 1.16% in the last 24 hours. The ERC-20 token is also seeing a bullish run as it is trading well above the 20-day moving average (MA) price of $2,064.26, with its relative strength index (RSI) standing at 61.59.

The Ethereum network is also set to become even more valuable when it migrates to its proof-of-stake (PoS) consensus protocol later on this year. The new algorithm will make Ethereum eco-friendly and more scalable.

2. Cardano (ADA)

One thing you should know about Cardano is that it aims to outperform the Ethereum network.

This singular mission has seen it dubbed an ‘Ethereum killer.’

Calling itself the third generation of blockchain technology, the Cardano network was founded by Ethereum’s co-founder Charles Hoskinson. It aims to be more scalable, secure, and interoperable, and it is gradually achieving its aims.

Using the popular PoS protocol, Cardano terms its approach the Ouroboros mining protocol, which cuts costs and reduces energy consumption.

So far, the Cardano network has been consistent with its roadmap, and it has generated much buzz around its project.

Even though the network is still under development, several investors recognize it as one of the best cryptocurrency to buy for long term returns. Their faith likely buoys that the Cardano network is the only peer-reviewed blockchain in the emerging industry. It leverages scientific processes and logic in developing its blockchain.

Like the Ethereum network, Cardano aims to attract dapps and ultimately DeFi services to its blockchain.

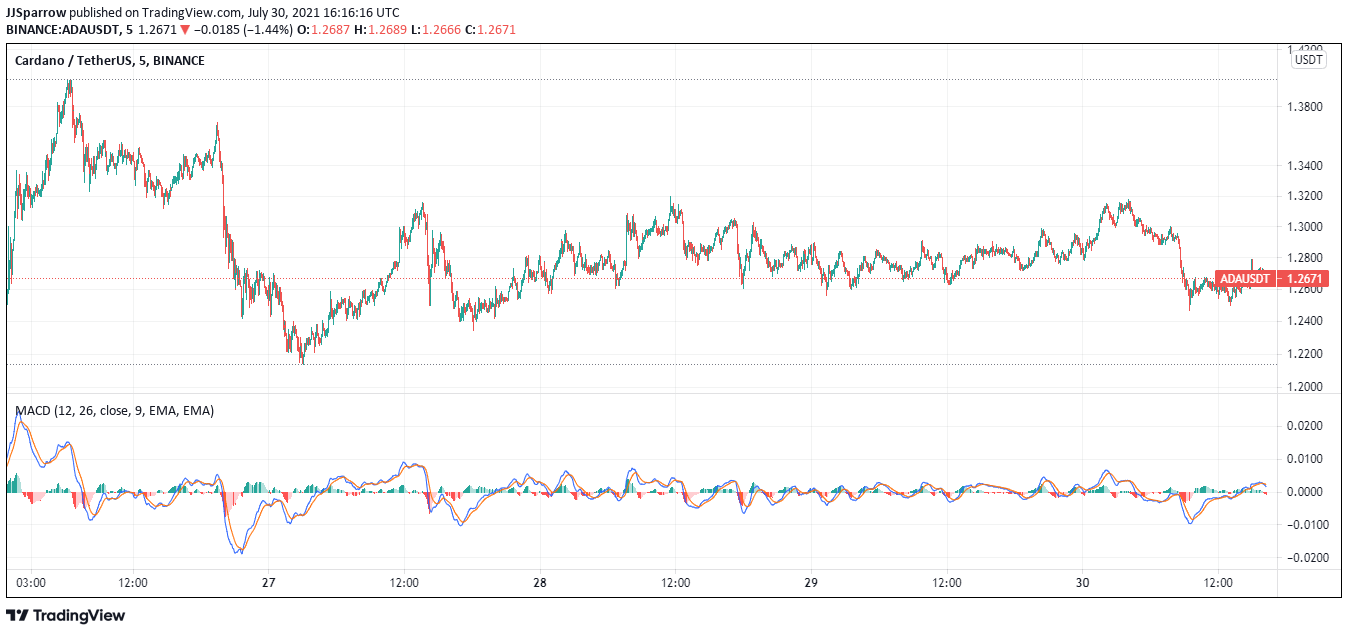

Price-wise, Cardano’s native token ADA is in its infant stages, but its growth potential shows it is meant for big things. It surged to an all-time high (ATH) of $2.3318 on May 16.

Even though it has since dipped with the market, ADA currently trades at $1.2648 and is down 0.96%. However, it is 10% higher than its two weeks low of $1.03.

HARD FORK SUCCESSFUL: Delighted to report around 19.44 UTC today we successfully forked the #Alonzo testnet to the new #AlonzoWhite node. The new network is happily making blocks already. 1/5

— Input Output (@InputOutputHK) July 14, 2021

The Cardano network is currently working on their Alonzo hard fork called Alonzo White Node. This stage will enable the launch of smart contracts technology on the Cardano network.

3. Solana (SOL)

Another popular ‘Ethereum killer’ is the Solana blockchain. Using a hybrid consensus protocol of proof-of-history (PoH) and proof-of-stake (PoS), Solana reportedly commands high transaction speed well over 50,000 TPS.

It also enables the development of dapps and is a growing hub for DeFi-facing products.

The Solana blockchain is one of the fast-rising stars in the hotly contested DeFi subsector and has been able to carve a name for itself given its faster transaction speed and cost-efficiency.

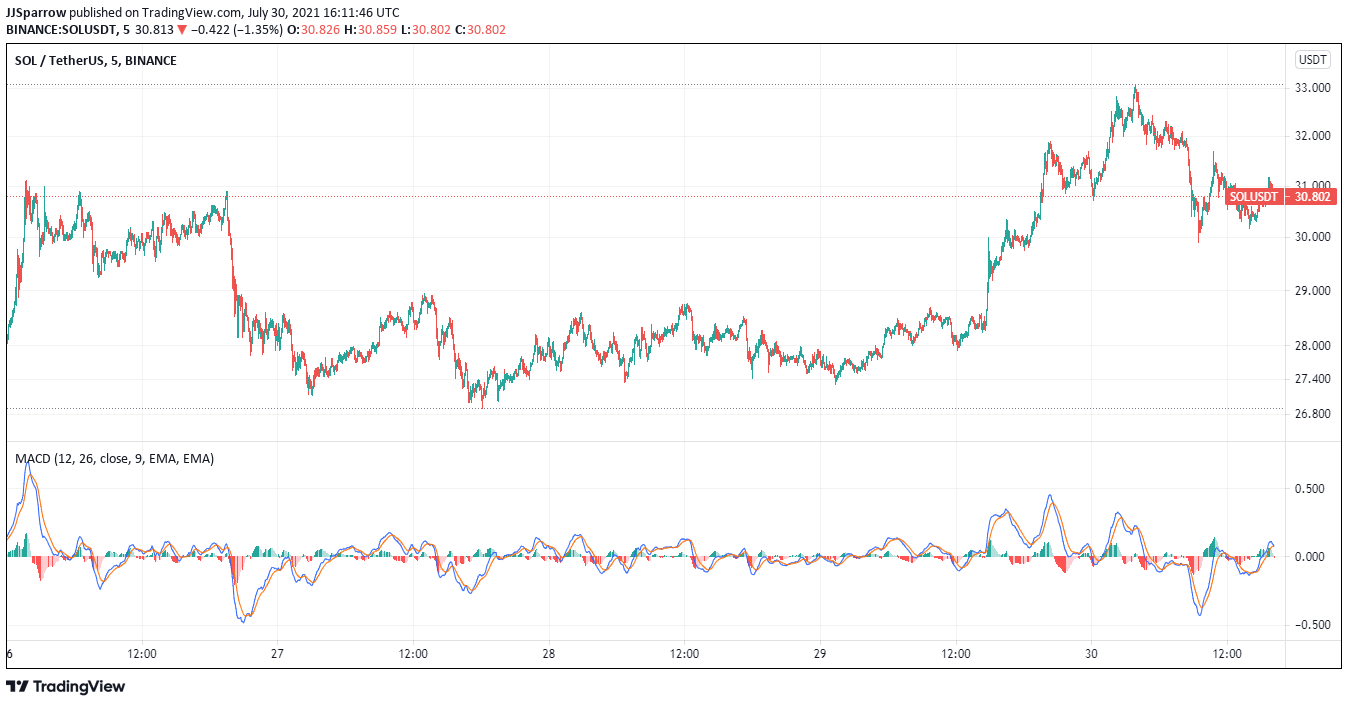

This growing recognition of its hidden superpowers has seen its native token SOL surge more than 800% to a record value of $55.91. Even though it soon dropped to $23.49 following the market downturn, SOL is still one of the best cryptocurrency to buy for long term returns.

Meanwhile, the digital asset is rallying and is up 9.75% and trading at $30.967. This rally has primarily been due to the changing atmosphere surrounding the crypto market and the blockchain’s strategic steps to expand its market appeal.

Namaste India! 🇮🇳

We’re incredibly excited to announce #BuildingOutLoud — a hackathon exclusively for Indian developers and entrepreneurs. pic.twitter.com/P66685xaSn

— Solana India (@solana_india) July 27, 2021

In a release, the Solana network said it was organizing a three-week hackathon venture exclusively for Indian developers and entrepreneurs. This is in a bid to make the Solana blockchain a top destination for all things DeFi.

4. Binance Coin (BNB)

Known popularly as BNB, Binance Coin is one of the best cryptocurrency to buy for long term returns. This recommendation is due to the token’s historical price performance and its growing importance to the Binance exchange.

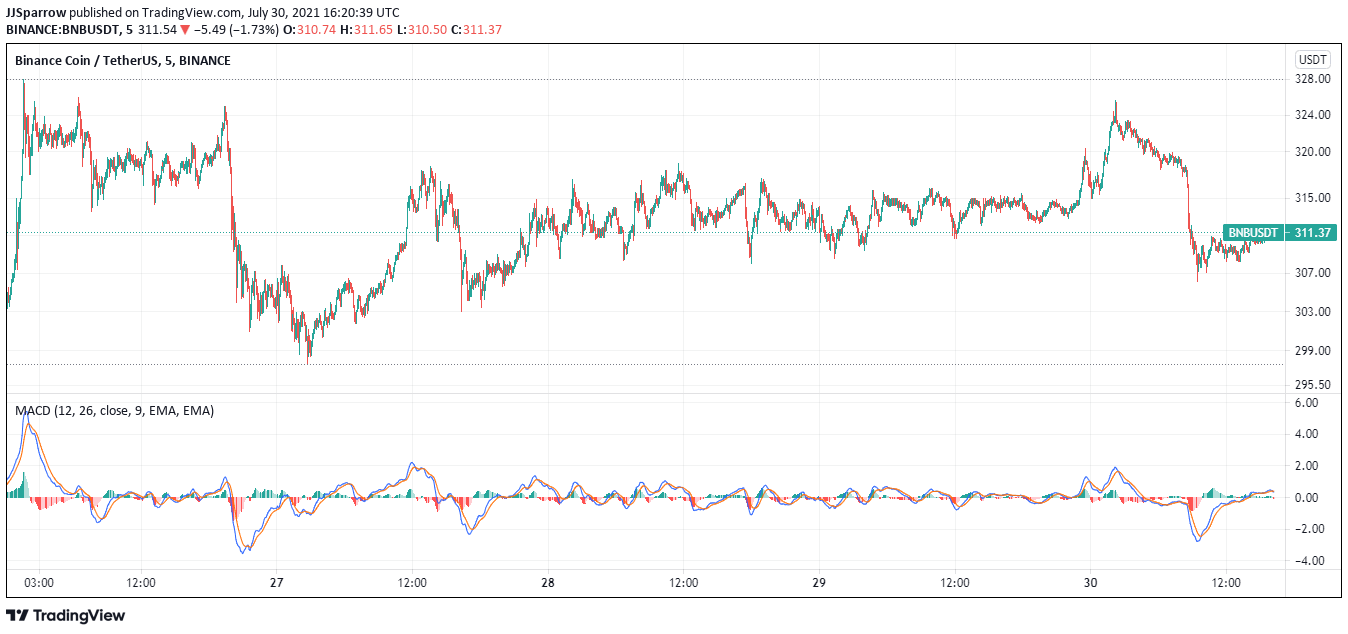

Serving as a discount tool for token holders who want to trade on the world’s largest exchange, BNB has grown more than 5,000% this year alone, plateauing at $650 before dipping 50%.

However, BNB is a top crypto asset due to its expanding use case in the Binance Smart Chain (BSC). BSC is a direct competitor to the Ethereum network.

Using a delegated PoS (dPoS), BSC enables developers to build dapps and create DeFi products easily and for a fraction of the cost. It currently hosts 1,000+ dapp protocols.

With BSC expanding so quickly, BNB’s value is expected to continue to rise in the long term.

This is because BNB is the only permitted token for use on the BSC platform. Another major plus is that BNB is deflationary as only 200 million BNB tokens will ever exist. In addition, the development burns (takes out of circulation) a certain percentage of BNBs from the market, which is expected to increase the token’s value.

It currently trades at $309.81 and is down 1.48% on the daily chart. This can be a great time to buy BNB for half its peak price.

5. UniSwap (UNI)

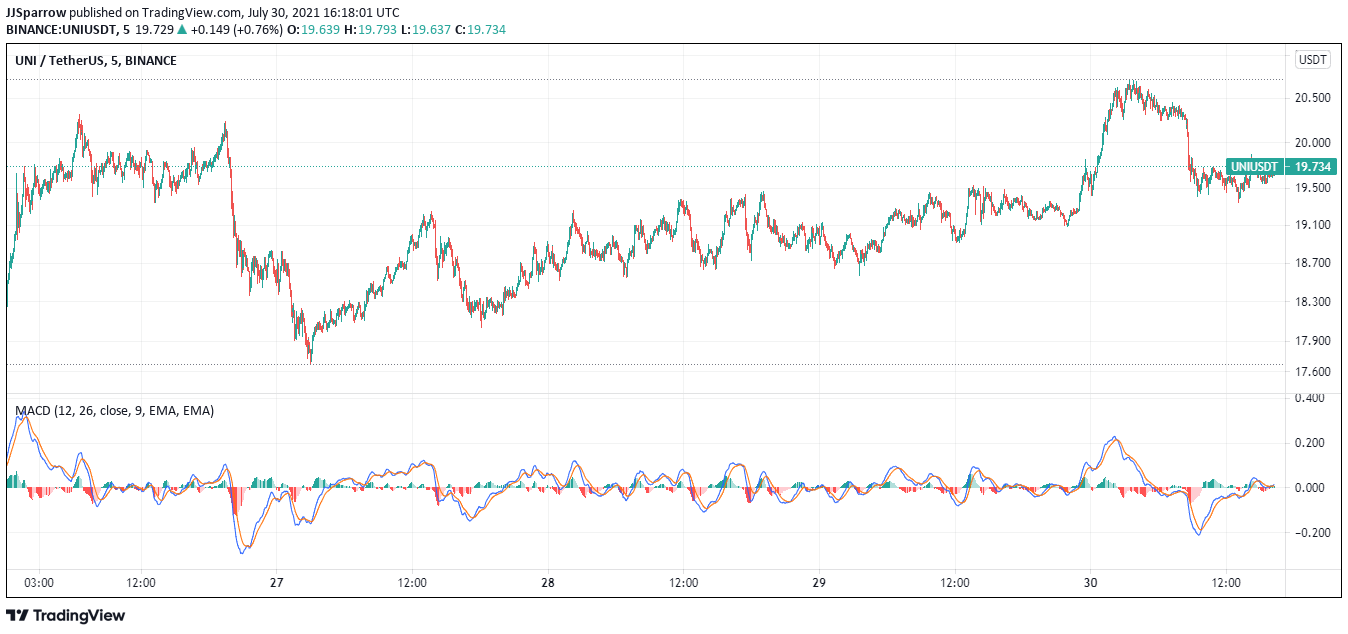

UniSwap has seen remarkable growth this year, rallying to a May 3 high of $43.48 from $5.19 on Jan. 1. This massive growth makes UNI one of the best cryptocurrency to buy for long term returns.

An automated market maker (AMM), UniSwap enables DeFi traders to get the best prices for their trades. Using smart contracts, UniSwap curates the best prices across different platforms and shows investors the best means of getting the best market rate for crypto trades.

It is built on the Ethereum network and is a decentralized exchange (DEX) platform. Unlike centralized exchanges (CEX), UniSwap does not use order books but relies on small contracts to address liquidity issues.

UniSwap has become a household name given the boom of the DeFi market. This has seen it become the top DEX platform on the Ethereum network and currently boasts over $1 billion in trades daily.

Its UNI tokens are used for network fees and governance. Investors can also stake their UNI to provide liquidity and earn interests from their investment.

At press time, UNI is trading at $19.662, up 3.48% in the daily chart. The UniSwap blockchain is currently in talks with payment giants PayPal, E*Trade, and Stripe. This is in a bid to make DeFi more accessible for mainstream investors.

Capital at risk

Credit: Source link