The cryptocurrency market has regained some strength after its slippage yesterday. Its total value now stands at $2.1 trillion, having fallen as low as $2 trillion, according to CoinMarketCap. Altcoins have led this rise, with the likes of solana (SOL) and cosmos (ATOM) outperforming bitcoin (BTC) over 24 hours. As with SOL and ATOM, many of the other coins leading the market today are noticeably cheaper than BTC. Accordingly, we’ve gone ahead and chosen the 5 best cryptocurrency to buy at cheap prices. This covers coins with a price under $200.

5 Best Cryptocurrency To Buy At Cheap Prices

1. Cosmos (ATOM)

ATOM is today’s best-performing coin in the top-20 of cryptocurrencies by market cap. It has risen by just over 12% in the 24 hours, to $35.37. This is a 40% rise over the past week, and a 128% rise in the past month. In fact, ATOM is on something of a roll recently. It reached a new all-time high of $38.69 less than a day ago.

Self-dubbed the ‘internet of blockchains,’ Cosmos has attracted attention this year following a couple of successful launches. Back in February, it rolled out Stargate, an upgrade that enabled its Inter-Blockchain Communication (IBC) protocol. The IBC permits communications between the separate chains comprising the Cosmos Network, and is key to its long-term success.

🚀 Cosmos, a 5 year journey into Stargate!

The Stargate Launch coming on Cosmos Hub on Feb 18th gives birth to the Internet of Blockchains and the start of a new paradigm into the crypto space.

Cosmos, we are Stargate ready! 🔥

🗓 Mark the date 👉 Thursday 18th Feb 6AM UTC pic.twitter.com/lLZ9EdELCP

— Cosmos – Internet of Blockchains ⚛️ (@cosmos) February 16, 2021

More recently, Cosmos also rolled out Emeris in mid-August. This is a cross-chain DeFi protocol that effectively lets any app on any blockchain interoperate with Cosmos. Again, it’s another essential ingredient in Cosmos’ long-term success, and should help it realise its aims of becoming an internet of blockchains.

2. Cardano (ADA)

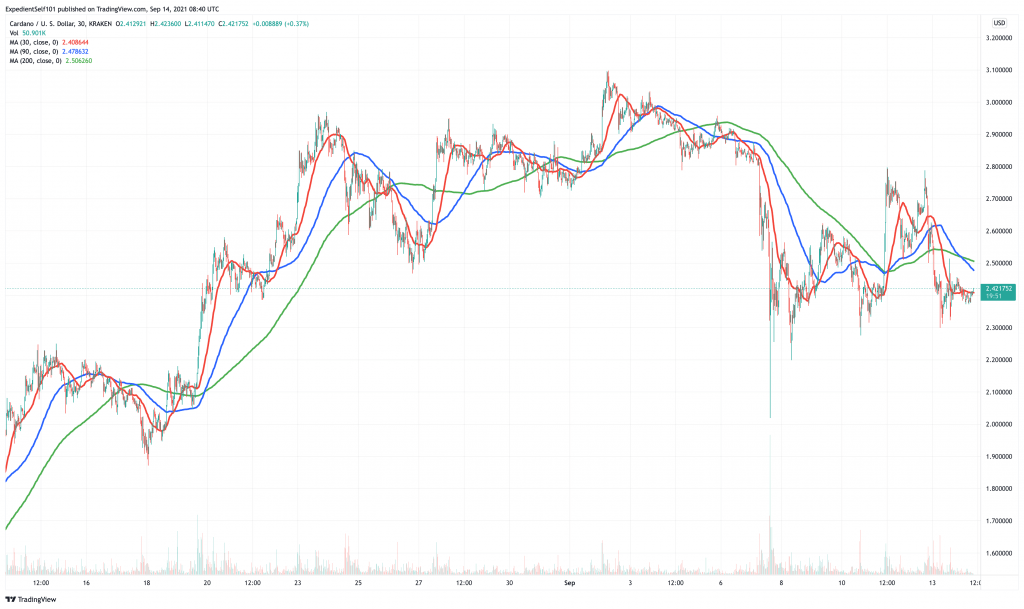

ADA has done well in the past 24 hours, despite falling over the past week. At $2.42, it’s up by 2% in the past day. On the other hand, it’s down by 15% in the past week, having fallen since reaching an all-time high of $3.09 on September 2. Despite this, it remains 10% up over 30 days and more than 2,400% up across the past year.

ADA’s price has benefitted from the rollout of Cardano’s Alonzo upgrade. Successfully implemented on Sunday, it makes possible the use of smart contracts on Cardano. However, while there has been a noticeable jump, it hasn’t been anywhere near as dramatic as expected.

This is likely because not enough projects have actually gone live on Cardano and begun using smart contracts. Now that smart contracts are up-and-running, there should be a gradual supply of projects launching in the coming weeks. If so, increased demand for ADA will create a supply squeeze. In turn, this will boost ADA’s price.

According to founder Charles Hoskinson, ver 100 companies have been waiting to launch on Cardano, so demand should end up being fairly high. An August 31 update on the Cardano ecosystem also found that it had integrated a comparably large number of projects in the buildup to Alonzo’s rollout. This apparent growth shows why ADA is one of the 5 best cryptocurrency to buy at cheap prices right now.

Aug 2021 VS May 2021

In just 3 months, Cardano has integrated 100 more projects spanning from DeFi to NFT.

Next target for $ADA should be $10🚀🚀🚀

🔄Retweet if u believe Cardano ecosystem will bomb like Big Bang explosion! #Cardano #ADA $ADA pic.twitter.com/zMLPF1LfVS

— Cardians (@Cardians_) August 31, 2021

3. Solana (SOL)

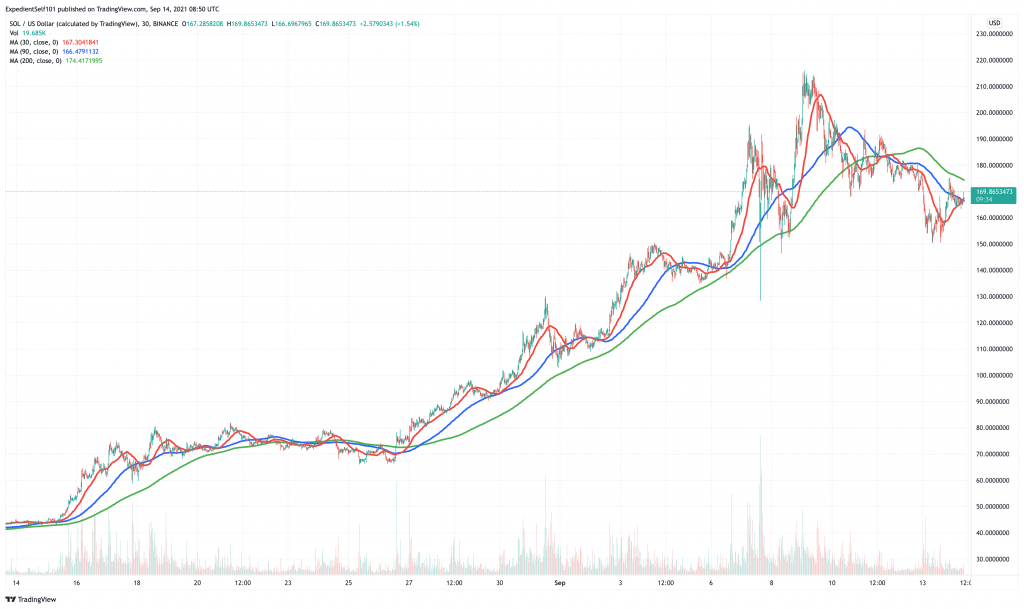

SOL is making up for lost ground at the moment. It’s up by just over 9% in the last 24 hours, rising to $168.50. While this represents only a 2% rise over the past week, it’s also a 53% gain across the last fortnight. More impressively, SOL has risen by 280% in the past month and by 5,000% in the last year. It hit an ATH of $213.47 only five days ago.

At the moment, SOL’s 30- and 90-day averages are under its 200-day average. However, the 30-day has begun rising again following today’s spurt. It may cross the 200-day average soon, creating a ‘golden cross’ that may indicate another breakout.

As we’ve noted before, SOL has been rising strongly ever since the launch of Wormhole. Released on August 9, this is a cross-chain bridge that lets users transfer tokens between Solana and other chains (e.g. Ethereum, BSC and Terra). Because it has opened Solana up to the users of other chains, its ecosystem has grown exponentially over the last month.

1/Today we’re incredibly excited to announce Wormhole: a generic cross-chain messaging protocol. Wormhole will launch with support for the thriving @Ethereum, @Solana, @Terra_money, @binancechain ecosystems. https://t.co/pEKdeOW821

— Wormhole (@wormholecrypto) August 9, 2021

In fact, Solana’s total value locked in has grown to roughly $11.5 billion since the launch of Wormhole. It had stood at $1.3 billion as recently as the start of August, revealing just how quickly it has ballooned.

Saber, the cross-chain stablecoin exchange, is a big factor in why Solana’s TVL has grown so much recently.

Saber just became the first protocol on @Solana to reach $2bn+ in TVL!

This comes just 3 days after reaching $1bn+ 🎉 pic.twitter.com/oH9Awe4ap3

— Saber (@Saber_HQ) September 8, 2021

Similarly, the Solanart NFT platform is another significant contributor to the growth of Solana’s ecosystem. It launched only two months ago, but celebrated breaking one million SOL in total volume by the end of August.

Almost two months ago, we launched https://t.co/tPritDMeeN, first #NFT marketplace on #Solana

Today, we broke 1,000,000 SOL in volume, and as $SOL breaks $100, that’s over $100,000,000 traded on our platform 🤯

Thank you for making us number one ❤️

New features coming soon 👀 pic.twitter.com/wjA0EFtTqf— Solanart – NFT Marketplace (@SolanartNFT) August 30, 2021

4. Iota (MIOTA)

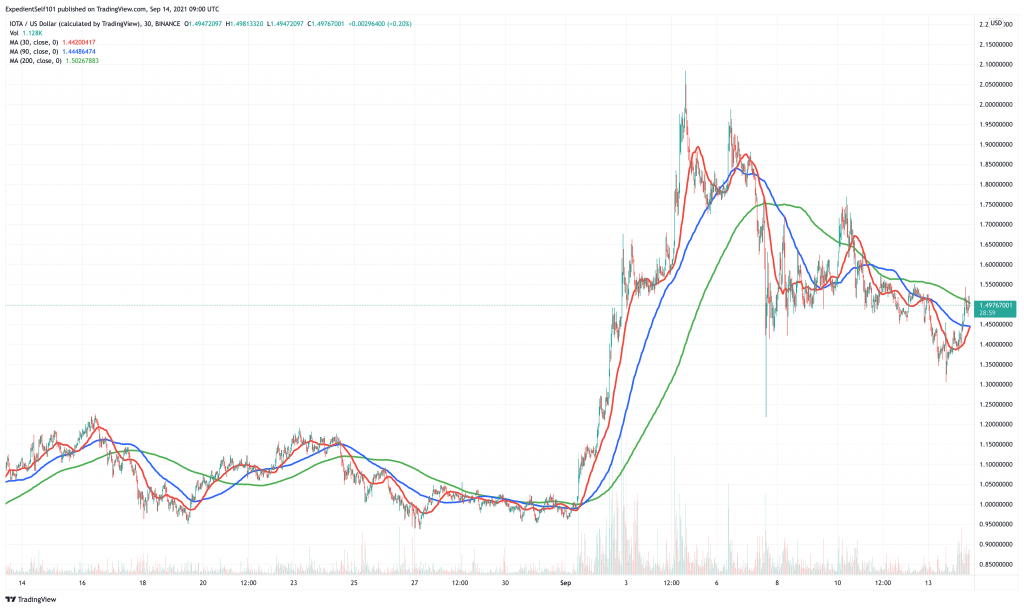

MIOTA is one of the best-performing coins in the top-50 today. It has risen by 11% in 24 hours, reaching $1.51. And while it’s down by 16% in the past week, it remains up by 56% in the past fortnight. It’s also up by 31% in the last month.

MIOTA is currently a long way from reaching its current ATH of $5.25, which was set in December 2017. This is arguably a sign of just how underbought and undervalued it is.

There are plenty of reasons to be quietly confident in Iota and its development. Most recently, the European Commission selected it to participate in the European Blockchain Services Infrastructure, one of seven projects in total. It will help design new blockchain solutions that could eventually be integrated into EU digital infrastructure.

🇪🇺 Building a distributed ledger technology for Europe.#IOTA selected to participate in EBSI, the European #Blockchain Services Infrastructure, by @EU_Commission @Connecting_EU.

👉https://t.co/D7pjrJCHMQ pic.twitter.com/nb7cGXMIsu

— IOTA (@iota) September 7, 2021

Iota is also working on a number of technical upgrades, including smart contracts and native assets. There’s no fixed date as to when these will go live. However, when they do, they will increase the usability and desirability of Iota significantly. Suddenly, $1.51 will start to look very cheap indeed.

Those already working on #IOTA Native Assets + Smart Contracts will be happy to hear that they will be available already before #Coordicide. Next step: defining specs for the Chrysalis integration.

🥳Join the discussion in #digital-assets on https://t.co/qcEar2Nd1z! pic.twitter.com/l6P72vJ7bk

— IOTA (@iota) August 20, 2021

Even before the recent EC announcement, Iota had been steadily growing its ecosystem and partnerships. On August 19, it revealed an extension of its ongoing collaboration with ClimateCHECK, which will use Iota’s Internet-of-Things blockchain for combating global warming.

[#ICYMI] Increasing trust in environmental data is a vital part of the fight against #climatechange. We’ve extended our partnership with @digitalmrv, @ClimateCHECK + @environmentca @eccc_news to use #IOTA #tech as a tool against #globalwarming.https://t.co/esreRevPwr

— IOTA (@iota) August 19, 2021

5. Uniswap (UNI)

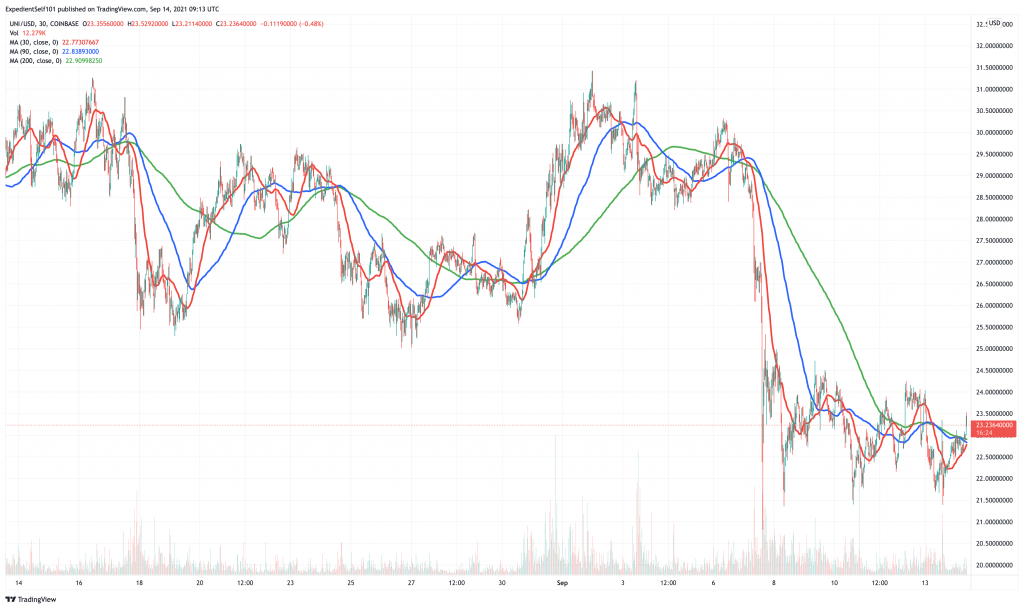

UNI has jumped by 6.6% in the past 24 hours, outperforming BTC and ETH. It now stands at $23.44, representing a fall of 19% in the past seven days. It’s also down by 22% in the past month, and remains 48% off its ATH of $44.92, set back in May.

UNI’s surge today means that its 30-day average is on the brink of crossing its 200-day average. This could be a good sign, so long as the momentum continues.

More generally, Uniswap has witnessed a few pieces of good news in recent weeks. Back at the start of September it welcomed the launch of Arbitrum. This is an optimistic rollup protocol that will help improve the speed and scalability of Ethereum-based apps. It has also been deployed for Uniswap, and recently celebrated passing $2 billion in TVL. This isn’t bad for a two-week-old protocol.

1/

🎉 Congratulations to the team at @OffchainLabs on the Arbitrum One launch!

📘 With this launch the Uniswap v3 Arbitrum deployment is now open for public use!

Read more here:https://t.co/sOSNuwtrtc https://t.co/aOtfwPWEnX

— Uniswap Labs 🦄 (@Uniswap) August 31, 2021

Uniswap launch v3 of its decentralised exchange back in early May. This was essentially a new exchange, with its TVL rising from $0 at launch to $3 billion by September 5. According to DeFi Pulse, Uniswap (including v2) is the sixth biggest DeFi platform in the ecosystem, accounting for over $6 billion TVL.

This gives Uniswap strong fundamentals, particularly at a time when centralised exchanges are attracting plenty of regulatory flack. This is why, despite recent disappointments, UNI is one of the 5 best cryptocurrency to buy at cheap prices.

67% of retail investor accounts lose money when trading CFDs with this provider

Read more:

Credit: Source link

![5 Top Cryptocurrency To Buy This Week [BTC,ADA, YFI, SOL, FIL] August 2021 Week 1](https://cryptocentralized.com/wp-content/uploads/2021/08/top-cryptocurrency-750x422.jpg)