Join Our Telegram channel to stay up to date on breaking news coverage

Unearth today’s five most promising altcoins, including Immutable, Cardano, and Algorand, presenting their market dynamics and growth potential.

The leading cryptocurrency, Bitcoin, is priced at $36,695, marking a 1.48% gain in the past day. Bitcoin’s dominance in the market slightly rose by 0.16%, now standing at 50.48%.

5 Best Altcoins to Invest in Right Now

These numbers indicate a steady movement in cryptocurrency, with moderate changes in market cap, trading volume, and Bitcoin’s value. This suggests ongoing interest from investors, contributing to the market’s overall stability and growth.

1. Immutable X (IMX)

Immutable recently announced a significant upgrade to its layer-2 blockchain, the Immutable zkEVM Testnet. This involves a switch from its original EVM client, Polygon Edge, to a Geth-based client, aligning the network more closely with Ethereum. The aim is to tap into Ethereum’s updates and ensure seamless compatibility with its tools.

Moreover, IMX’s objective is to enable Immutable zkEVM to support multiple primary Ethereum clients. This diversity strategy aims to bolster the network against client-level bugs and vulnerabilities.

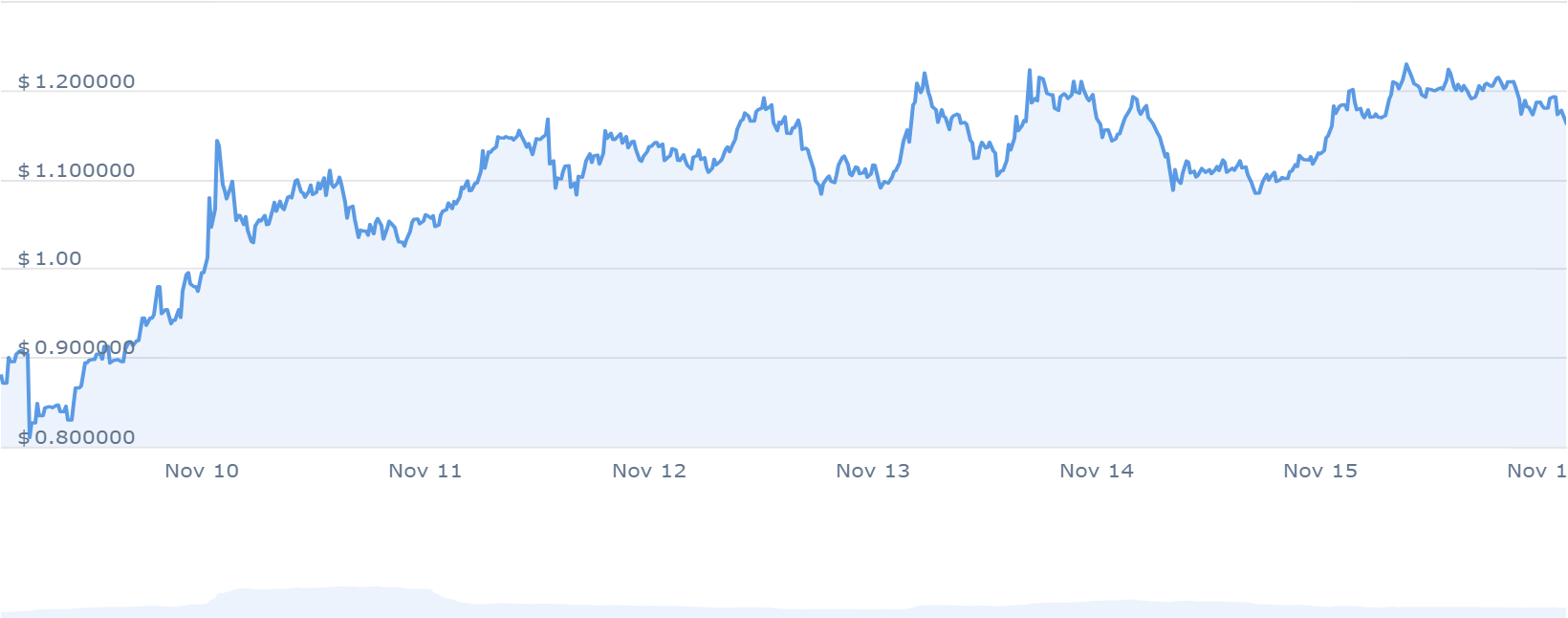

Regarding financial performance, Immutable X has shown remarkable growth over the past year. Its price surged 188%, outperforming 89% of the top 100 crypto assets, including Bitcoin and Ethereum. The token consistently traded above its 200-day simple moving average. In addition, it has shown positive performance compared to its token sale price.

In the last 30 days, Immutable X experienced 21 days of positive price movement, accounting for 70% of the period, signaling an upward trend. It also exhibits high liquidity, evidenced by its market cap.

Immutable 🤝 Ubisoft’s Strategic Innovation Lab

Immutable, the leading web3 gaming platform, is joining forces with Ubisoft’s Strategic Innovation Lab to create a new gaming experience to further unlock benefits for players through the power of web3.

This is another significant… pic.twitter.com/x3XvHwP0Zd

— Immutable (@Immutable) November 9, 2023

Regarding supply, Immutable X has a circulating supply of 1.25 billion IMX out of a maximum supply of 2.00 billion IMX. The yearly supply inflation rate is 84.24%, creating 572.35 million IMX last year. Furthermore, by market cap, Immutable X holds the #2 position in the Layer 2 sector.

2. Internet Computer (ICP)

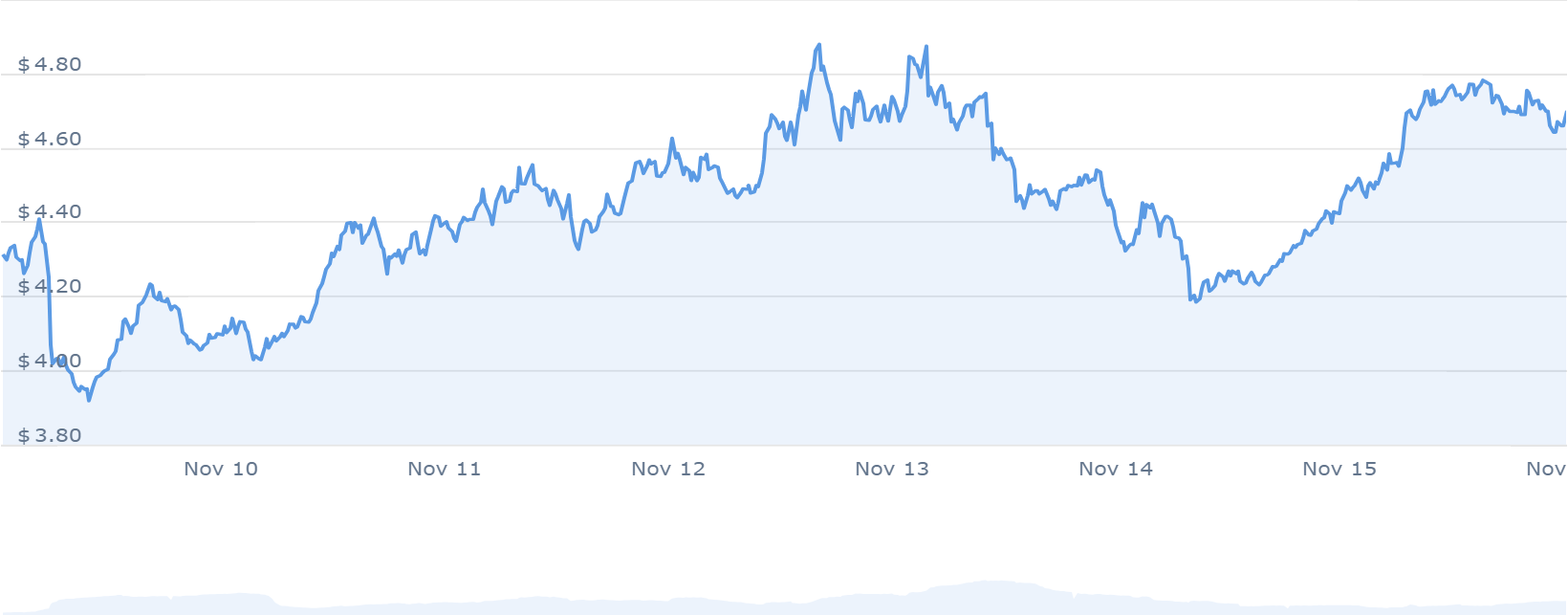

Internet Computer (ICP) has seen notable shifts in its performance over the past year. Its price has increased by 20%, indicating a significant rise in value. Comparatively, it outperformed 52% of the top 100 crypto assets during this time. Additionally, it’s currently trading above the 200-day simple moving average, suggesting a positive trend.

One key highlight is its positive performance compared to its token sale price. Moreover, it experienced 17 green days out of the last 30, accounting for 57% of the period, showcasing intermittent growth. The token is trading near its cycle high, indicating a favorable market position. Its liquidity, evidenced by the robust market cap, ensures smooth transaction flow.

As of the latest data, ICP is valued at $4.70, with a 24-hour trading volume of $111.62M and a market cap of $2.11B. Notably, it reached an all-time high of $497.71 on May 10, 2021, and an all-time low of $2.86 on Sep 22, 2023. The current market sentiment leans bullish, reflected by a Fear & Greed Index 70, signaling investor confidence.

It’s essential to note the current circulating supply of ICP, which stands at 449.25M out of a maximum supply of 488.51M. The yearly supply inflation rate is 64.30%, creating 175.81M ICP within the last year. In the Layer 1 sector, Internet Computer maintains its position at #20 based on market cap rankings.

3. Cardano (ADA)

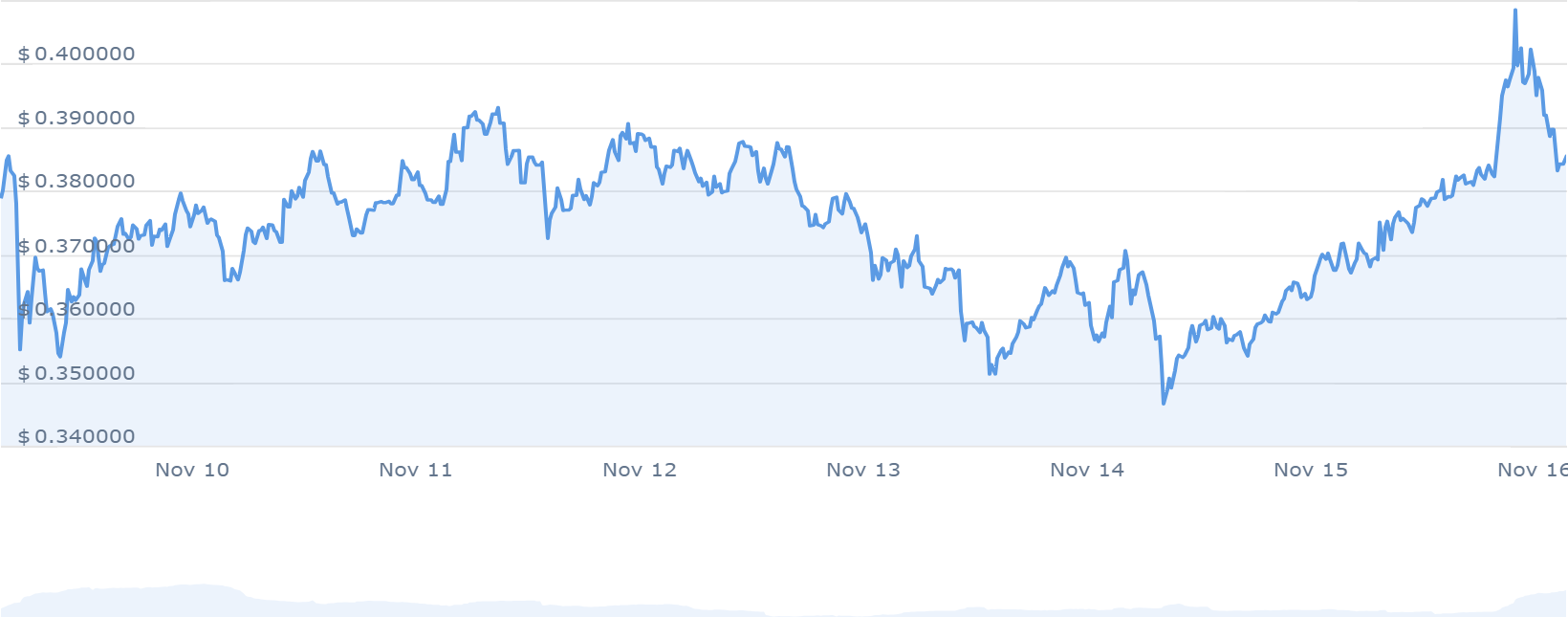

Cardano, currently ranked 6th in the Layer 1 sector, has shown notable price movements over the past year. In the last year, Cardano’s price has increased by 15%. However, it’s noteworthy that it outperformed only 51% of the top 100 crypto assets during this period. Thus indicating a moderate comparative performance.

As of the latest data, Cardano is trading at $0.384319, experiencing a 4.49% surge in the past 24 hours. This surge contributes to its bullish sentiment in terms of price prediction. Moreover, it is supported by the Fear & Greed Index, which stands at 70 (Greed).

From a technical analysis perspective, Cardano trades above the 200-day simple moving average, indicating a positive momentum trend. Furthermore, Cardano has seen 21 green days in the last 30 days. This accounts for 70% of the observed trading period, suggesting a recent upward trend.

🏆 Cardano Summit 2023 Awards

🎊 Congratulations to the winners in the category Developer or Developer Tools

👏 @txpipe_tools

👏 @StricaHQ #CardanoSummit2023 #CardanoCommunity pic.twitter.com/jcVxOBm4s8— Cardano Foundation (@Cardano_CF) November 9, 2023

Based on historical price points, Cardano reached its all-time high on Sep 2, 2021, at $3.10. Conversely, its lowest recorded value was $0.017354 on Oct 1, 2017. Since its ATH, the lowest price observed was $0.223375 (cycle low), and the highest ADA price post that cycle low stood at $0.409089 (cycle high).

Regarding market cap and supply dynamics, Cardano currently has a circulating supply of 33.82B ADA out of a maximum supply of 45.00B ADA. Likewise, it has a market cap of $13.00B and a market dominance of 0.91%.

4. Bitcoin ETF Token (BTCETF)

The Bitcoin ETF Token project has emerged to capitalize on the potential approval of a Bitcoin Exchange-Traded Fund (ETF). It aims to create a single token to increase investors’ exposure to this development. Even with the introduction of an ETF, experts project potential gains from Bitcoin to be around 1 to 3 times its current value.

Grayscale’s move with an $ETH futures #ETF might be a chess play to secure a spot for an #EthereumETF approval.

Bloomberg’s analyst James Seyffart sees it as a ‘trojan horse’ tactic.

How do you perceive this regulatory chess match?#BTCETF has also now raised over $800K!🚀 pic.twitter.com/DW2DclMzOu

— BTCETF_Token (@BTCETF_Token) November 16, 2023

So far, BTCETF has raised $868,796 from its $1,310,400 funding goal, indicating significant buyer interest. This rising interest might position the coin as a potential investment option. Notably, there’s a limited 4-day window until a potential price adjustment.

In summary, the Bitcoin ETF Token project is centered on the expected ETF approval for Bitcoin, offering a distinct strategy for potential returns. Its current status shows considerable interest from investors.

5. Algorand (ALGO)

Quantoz Payments, a Dutch blockchain firm Quantoz subsidiary, has recently acquired an electronic money institution (EMI) license from the Dutch Central Bank. This milestone empowers them to issue EURD, a regulated euro legal tender, on the Algorand network. The EURD is set to be available across the European Economic Area by year-end.

EURD’s launch aims to facilitate payments to internet-connected device avatars and bolster the Web3 economy. It’s designed to enable economically viable microtransactions, potentially compensating sensor data and facilitating machine-to-machine transactions.

In addition to being a regulated digital euro, the EURD claims robust privacy measures. Moreover, it aims to cover transaction fees and offer programmability for enhanced efficiency.

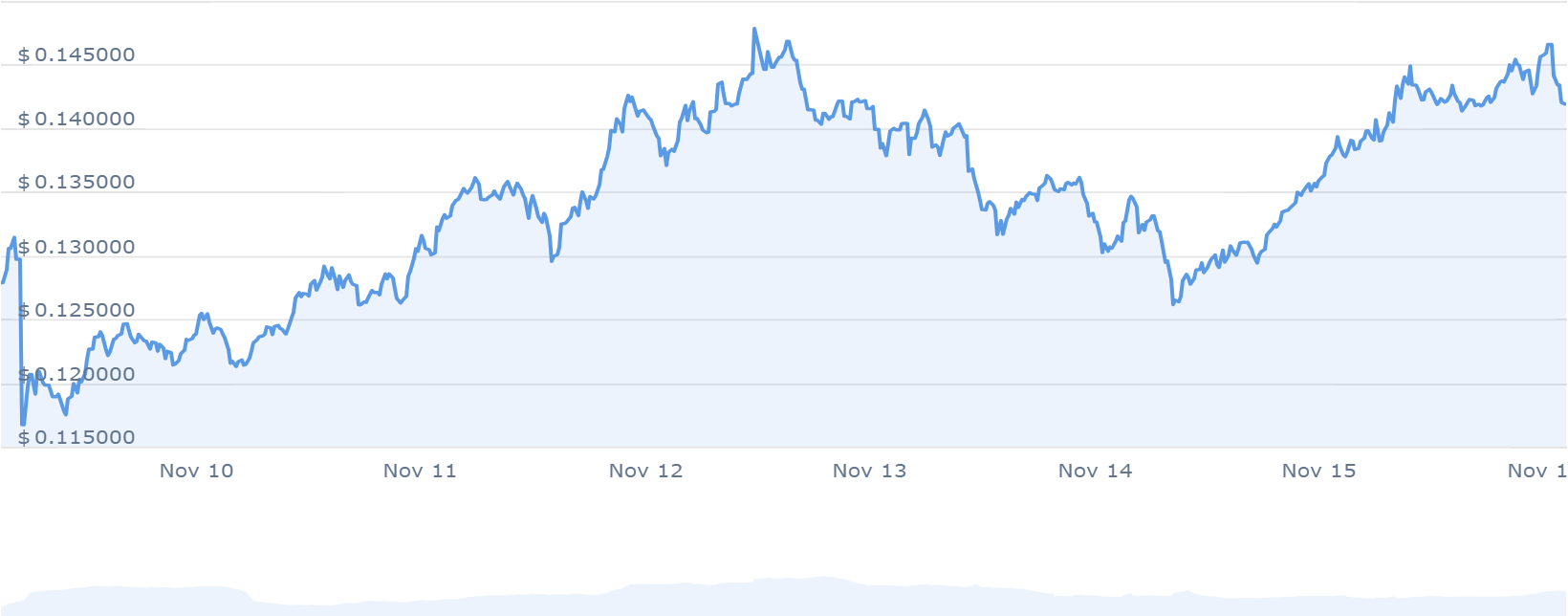

Algorand, the platform where EURD will be issued, trades above its 200-day simple moving average. It boasts 20 positive days out of the last 30 (67%) and enjoys high liquidity on Binance.

Furthermore, Algorand’s current metrics show a trading price of $0.140899 and a 24-hour trading volume of $156.05M. It also possesses a market cap of $1.13B and a market dominance of 0.08%. Over the last 24 hours, its price increased by 1.28%.

Regarding sentiment, Algorand’s price prediction is presently neutral, and the Fear & Greed Index reflects a level of 70 (Greed). Its circulating supply stands at 8.01B ALGO out of a max supply of 10.00B ALGO. It also has a yearly supply inflation rate of 12.73%, creating 904.33M ALGO in the past year.

In summary, Market cap rankings show that Algorand holds #11 among Proof-of-Stake Coins, #3 in the Algorand Network sector, and #26 in the Layer 1 sector. These rankings, coupled with the positive market sentiments, make ALGO a coin worth watching.

Read More

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link