Our selection of the 3 best cryptocurrencies to buy for DeFi price gains will help you capitalize on this investment growth story, even amidst the crypto breakdown.

The crypto market is engulfed by bearish sentiment, which means anyone looking to invest in cryptocurrencies should be cautious. However, you can win in the market slump by investing cleverly in the best cryptocurrencies.

Digitalized currencies currently have a market capitalization of $1.05 trillion today. Given that, this enormous value and the thousands of coins in the ecosystem make it quite challenging for you as an investor to choose the coins to focus on.

Although investing in a coin depends on a number of factors, one is the ability for a coin to stay afloat even when the entire crypto market takes a bearish direction. That requires good fundamentals and being in the right sector of the crypto market.

Today we outline the 3 best cryptocurrencies in the DeFi sector with strong fundamentals which means you should consider buying them for future above-average price gains.

3 Best Cryptocurrencies Worth Buying For DeFi Price Gains

1. Why Buy Uniswap (UNI)

Uniswap is the number one crypto to buy for DeFi price gains. UNI is an Ethereum-based decentralized exchange (DEX).

It was established on November 2nd, 2018, by former Siemens Engineer Hayden Adams. The goal of Uniswap is to ensure seamless coin trading while handing over the governance to the users.

The platform eradicates trustless transactions or the presence of third parties and order books. The native token for the DeFi Exchange is the UNI token which is used as a governance token and basic transactional token in the entire exchange. The Total Value Locked in Uniswap is $6.18 billion.

Since its launch on the 16th of September, 2020, the coin has experienced an impressive growth from a launch price of $1.03 to an all-time high price of $43.81 on May 3rd, 2021, which is a whopping 4153.4% increase.

Succeeding that was a 9-day price depreciation affected by the general decline in the crypto market, which commenced on the 15th of May, 2021, until the 24th May, 2021.

The current price for the UNI coin is $22.36 with a market capitalization of $13 billion as its current market direction is bearish, although price predictions have it that the coin will soon be experiencing the next gain in a few days.

The Uniswap provides you multiple functional advantages, which include trustless transactions, impermanent losses, staking rewards, and, very importantly—relatively low gas fees of 0.3% transaction charges.

2. Why Buy Aave (AAVE)

The AAVE protocol is a digitalized network that allows users the unique ability to participate in the network, either as a lender or a borrower. It is hosted on the Ethereum mainnet. AAVE joined the crypto race in 2017.

The network allows users to lend and borrow up to 17 assets and profit from them. The governance token for the network is called “AAVE” and is used as the primary transactional token for its numerous utilities.

Aave offers its users a unique mode of profiting through its lending accessibility and attractive interest rates. The interest rates in the Aave platform are divided into two— the stable and the variable interest rates.

The stable interest rate comes from the average of a month (30 days), whereas the variable rate is determined using algorithms to note the demand from users—an increase or decrease will change the rate for both borrower and lender. And these rates can easily be switched by the user at any point in time.

The token’s ICO was held on November 25, they raised up to $16.2 million. Currently, the Total Value Locked in UNI is up to $12.63 billion with a daily trading volume of $363.77 million.

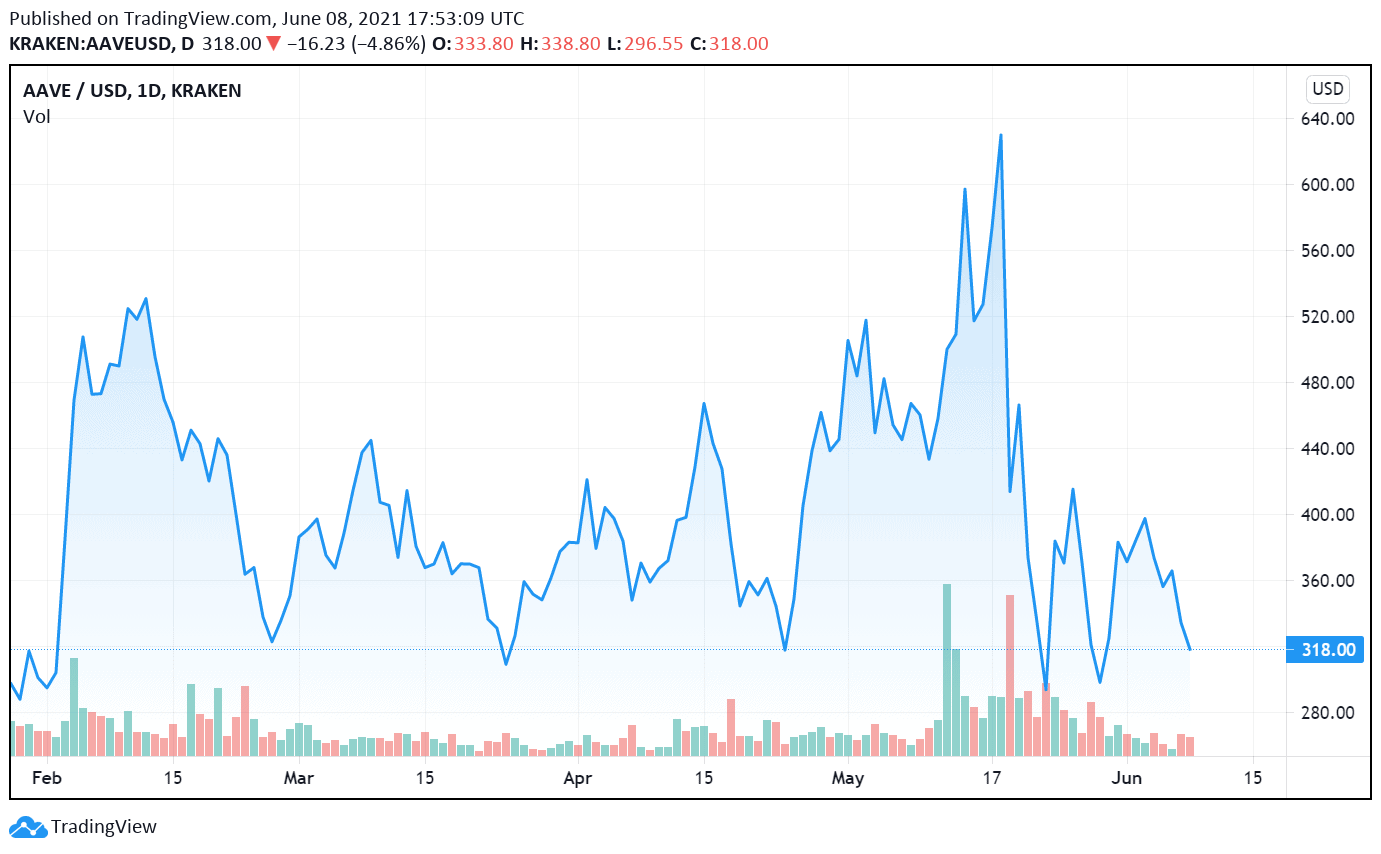

It recorded its highest price of $667.43 on the 24th of May, 2021. At the time of writing, Aave is selling at $316.22 after plunging from $375 in the last 24 hours.

Variable cryptocurrency investors predict that the AAVE token will amount to $442.03 by December 2021 and up to $1,460 by 2026. So it makes AAVE an ideal cryptocurrency to buy at a low price.

3. Why Buy Compound Token (COMP)

The Compound Foundation created Compound in 2018. The CEO of the Foundation is Robert Leshner. The compound is a decentralized lending protocol built in the Ethereum blockchain. It supports the borrowing of ERC-20 tokens to users for yield farming.

This is a process by which a user deposits an amount of money into the liquidity pools and earns some crypto assets as rewards. This user can again reinvest the asset he or she borrowed back into the pool to get more crypto incentives.

In Compound, users can withdraw only a percentage of what they invested into the pool.

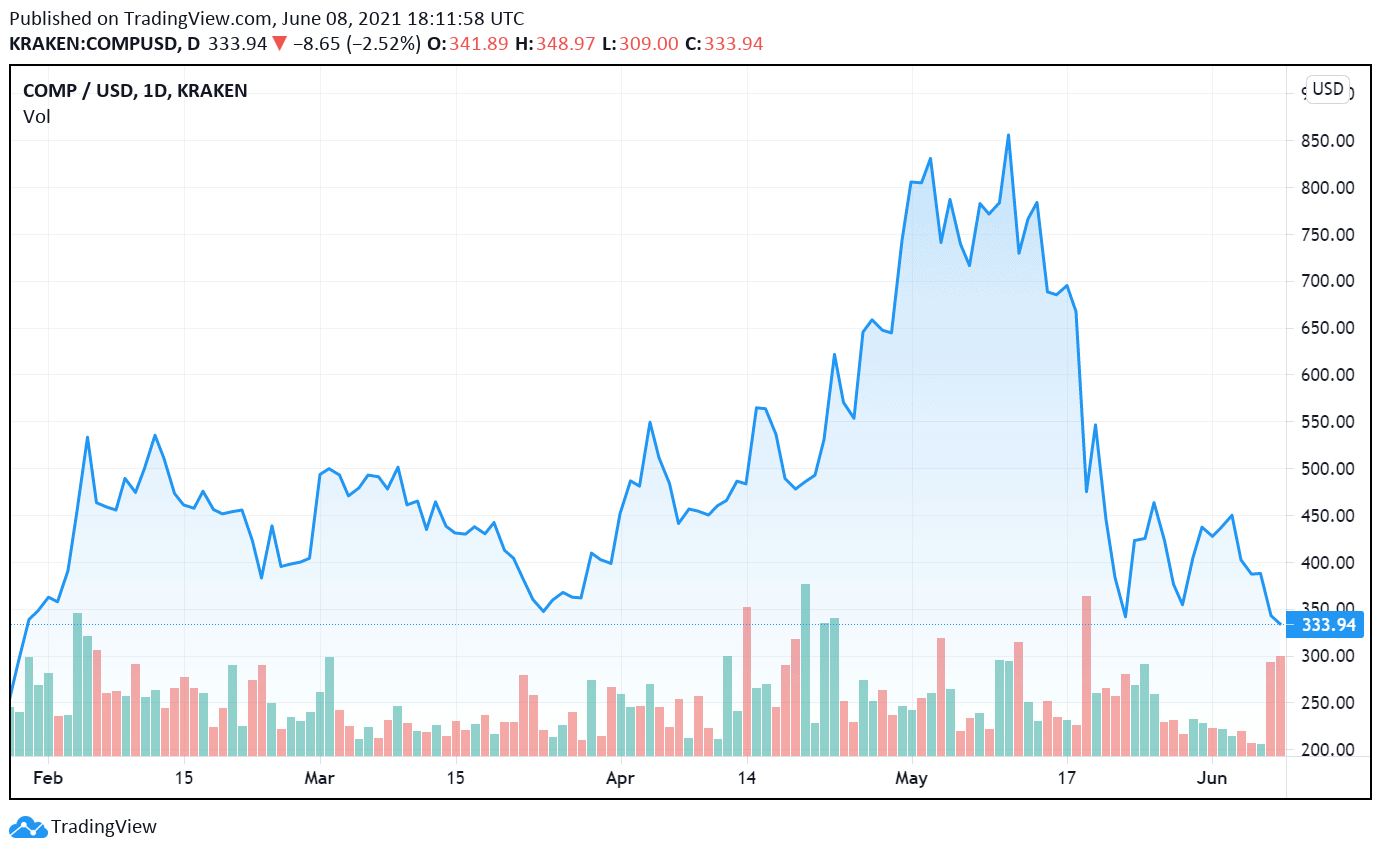

On the 25th of June, 2020, Binance listed the token on its exchange, causing a huge increase in the price afterward. The token experienced an all-time high price of $911 on the 12th of May, 12, 11 months after its lowest price of $61.25 on 18 June 2020, over 1387% difference.

Today, the COMP token is priced at $333.9. It has a market capitalization of over $1.6 billion in circulation with a Total Value Locked of $7.5 billion.

The coin was also affected by the general market decline in May 2021. It experienced a 43.438% decrease between May 13th and May 27th, 2021. Subsequently, the COMP is plunging as the market goes all red. Though, it’s the best time to buy COMP.

Compound’s previous history suggests that it will thrive once the bulls have taken over the market. And this makes COMP an appealing coin to buy.

Why Buy 3 Cryptocurrencies for DeFi Price Gains

DeFi tokens can be complicated so if one doesn’t understand the protocols and their markets, investing in the right cryptocurrency will be difficult to get right, so hopefully, after reading this article you are better informed.

We have picked the 3 best cryptocurrencies we think have the highest chances of achieving above-average gains over the medium and long term.

The Uni, Aave, and COMP tokens represent a trio on truly adventurous price journeys.

Lastly, they are all Ethereum-hosted which is the most used smart contract platform in the world and where liquidity is plentiful.

Looking to buy or trade Crypto now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link