Nearly 78% of Bitcoin’s total circulating supply is illiquid, according to Glassnode on-chain data analyzed by Cryptoslate, leaving less than 22% of all mined BTC moving around and exchanging hands.

The metrics show investors have been pulling their digital assets away from exchanges and storing them in custodial wallets, to avoid selling them.

Cryptoslate delved into the supply metrics of Bitcoin to evaluate the long-term perspective of the coin after weeks of market turmoil and uncertain macroeconomics. The analysis revealed more Bitcoin had become illiquid despite trading downwards for nearly the entire of 2022.

Illiquid supply is a vital crypto data set as it implies only a few weak hands (a quarter of all BTC supply), can sell their holdings and exert bearish pressures.

On the other hand, it also implies large-scale buyers are going to acquire more BTC from whales, institutions and strong hands.

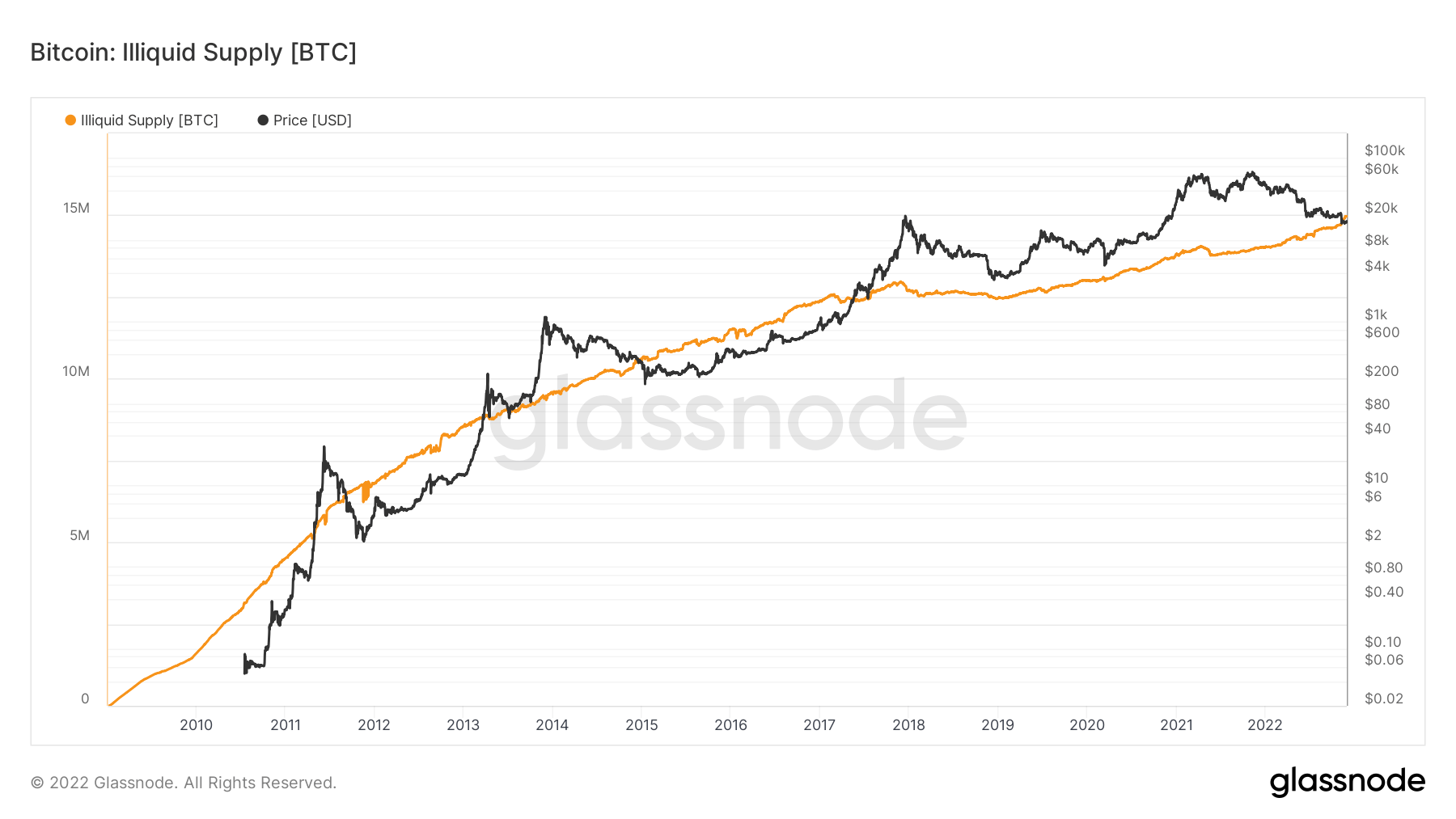

The chart below demonstrates the movement of Bitcoin into illiquid supply since 2010, the amount of BTC getting into illiquid hands is roughly three-quarters of the total circulating supply.

Think of illiquidity as the point when Bitcoin moves to a wallet that shows no spending history, while liquidity is when BTC moves to wallets that have a history of spending such as hot wallets and exchanges.

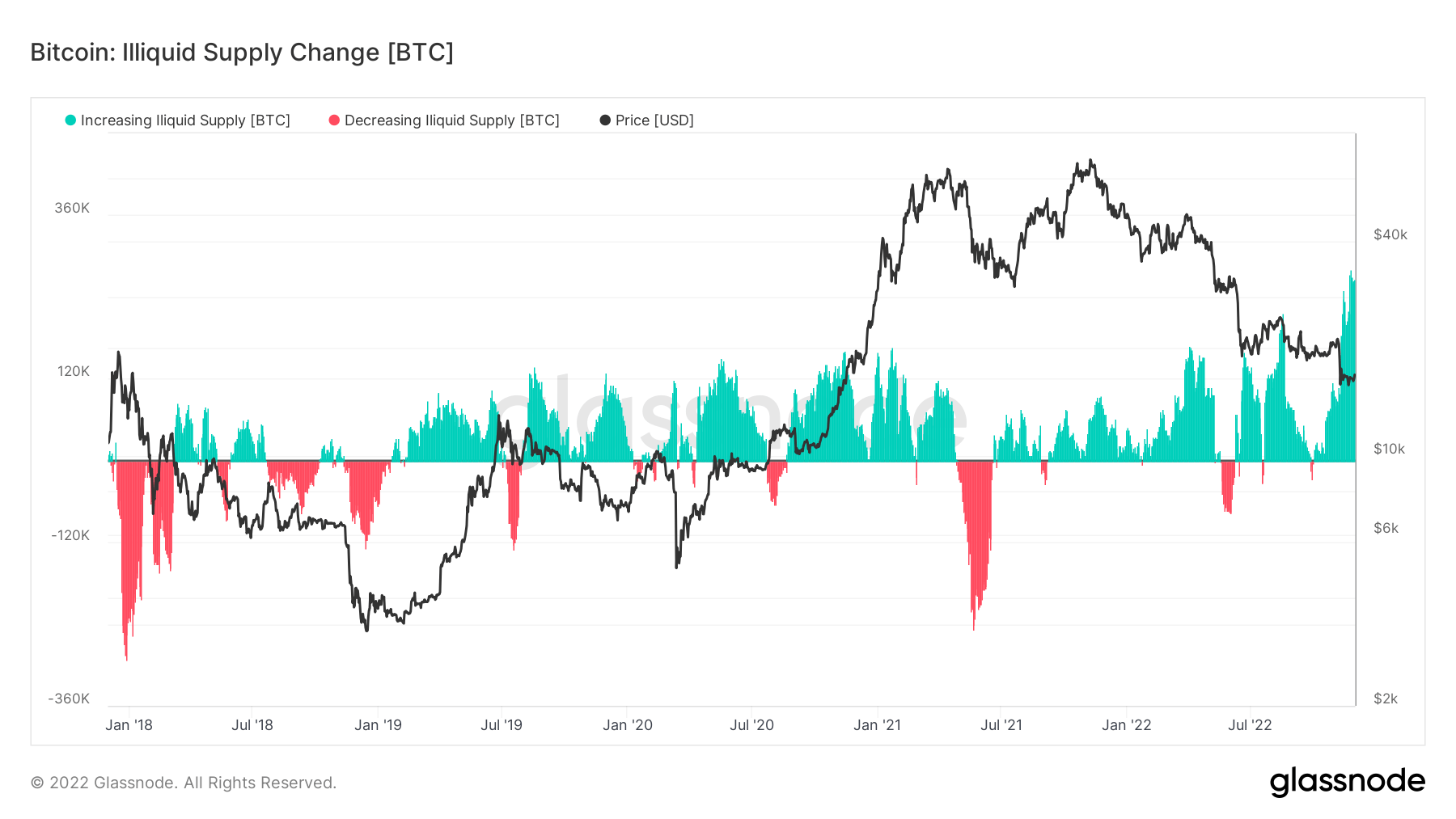

The above metrics suggest more BTC is moving into cold storage and implies a prevalence of hodling and accumulation. Better yet, falling liquid supply as shown in the chart below is an indication of subsiding major sell-offs and capitulation. The same Glassnode data indicates Bitcoin has recorded the fastest rate of change

The same data by Glassnode recorded the fastest rate of change of BTC moving into long-term holders over the last 5-years, also referred to as illiquid supply change. Therefore suggesting long-term holders have stopped spending their Bitcoins and are now in the accumulation stage.

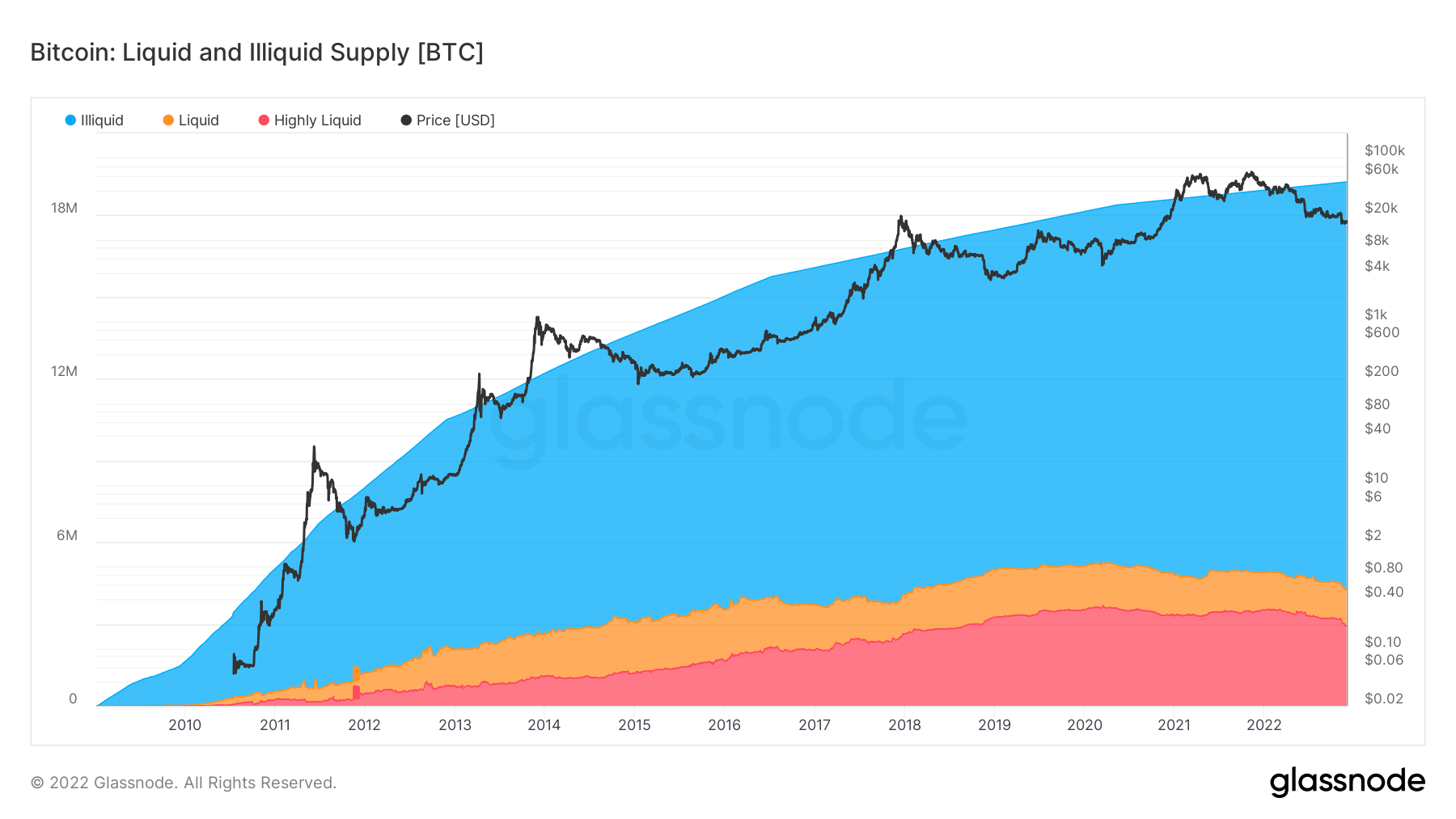

While a whopping 15 million BTC coins are not available for sale, only 4.3 million BTC coins will be in constant circulation and in the liquid/highly liquid category. A large majority of these coins are held either by short-term investors or traders. Thus positioning Bitcoin’s supply shock at the same level as when it was priced at $53K, which implies short-term holders have lost to long-term holders.

In fact, the rate of growth for liquid supply has been slowing down over the past months, a situation that can be attributed to a more bullish long-term overview, and increased concerns around the safety of funds stored across exchanges and hot wallets.

The chart above demonstrates the amount of highly liquid and liquid BTC assets and shows the figures are currently 3 million and 1.3 million coins respectively. The data is clear that both liquid and highly liquid supply have been trending downwards amidst the current market turmoil.

Credit: Source link